Gold, ah yes — that timeless, glittering refuge for investors, central banks, and even the occasional treasure-hunting pirate fantasia. Lately, conversations around “Gold Price Prediction: Can Gold Reach New Record Highs?” have picked up pace—especially as inflation jitters, central bank policies, and geopolitical flashpoints create a swirl of uncertainty. This essay dives into whether gold is poised for another surge, weaving narrative nuance with technical patterns, real-world case studies, and a smattering of human-like asides—because, let’s face it, reading about gold shouldn’t be as dry as a desert.

Let’s dig into the story. We’ll trace macroeconomic currents, investor psychology, technical chart patterns, and precedent examples like the 2020–2021 gold run. We’ll ask: Could gold break its all-time highs soon? Or is another chapter of sideways drift more likely? And crucially, how might you think about this if you’re an investor, a curious watcher, or just someone who’s always daydreamed about hoarding bars in a secret vault? It’s gonna be a bit messy in a human way, but hopefully that’s the fun part—expect imperfections, surprises, and a touch of unpredictability in how ideas flow.

Macro Drivers of Gold Prices

Inflation, Central Bank Moves, and Safe-Haven Appeal

Gold’s reputation as inflation hedge is, admittedly, a bit overplayed—but there’s a thread to it. In periods of elevated inflation—or even the threat of it—gold often gains traction because it’s perceived as a store of value when fiat currencies appear shaky. For instance, when inflation expectations climb, some investors tilt into gold as a defensive asset. Yet, that relationship isn’t airtight; high real yields can dampen gold’s appeal even amid price rises.

Meanwhile, central banks wage tug‑of‑war with interest rates. Lower policy rates, or a dovish tone, often reduce opportunity cost for holding non-yielding gold. Take 2020–2021: globally accommodative monetary policy, plus fiscal stimulus, buoyed gold prices toward their record highs around $2,050 per ounce.

Then there’s the safe-haven dimension. Geopolitical snags—say, escalating tensions in the Middle East or surprise shocks in Europe—tend to push investors toward gold. It’s subtle psychology: gold doesn’t promise interest, but under crisis, it feels solid.

In summary, three macro vectors—real yields/inflation, central bank direction, and geo-strategic anxiety—drive gold’s pull. But none is foolproof. They often interplay, so the question of “new highs” hinges on a confluence of these forces aligning.

Technical Patterns and Market Sentiment

Chart Structures and Momentum Signals

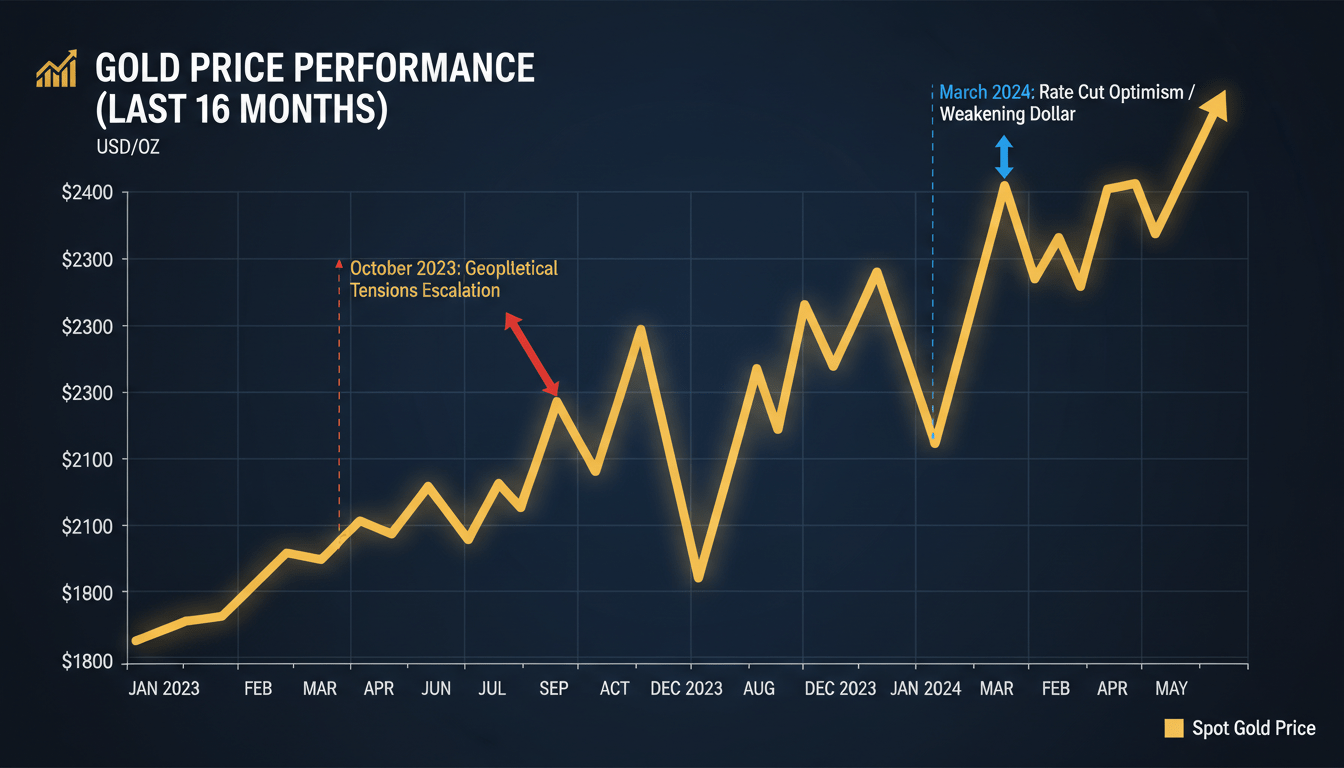

When it comes to chart watchers, patterns like head-and-shoulders, triangles, or breakouts get tossed around like buzzwords. But they do offer context. In late 2025, gold spent months consolidating in a triangular zone, swinging between $1,950–$2,000. A decisive breakout above that zone traded at ~$2,040, suggesting renewed upward momentum. Of course, whether that morphs into a sustained rally depends on volume, breadth, and follow-through during key resistance tests.

Momentum indicators—like the relative strength index (RSI)—are also useful. If gold wrestles above 70 on RSI, it may signal short-term overbought conditions, flagging potential pullback. Conversely, if momentum lifts off from oversold levels, that could hint at renewed bullish energy. But here’s the catch: these signals can stay elevated a long time in trending markets, so they’re not always reliable exit triggers. It’s more art than science.

Investor Positioning and Sentiment Indicators

Beyond charts, the Commitment of Traders (COT) reports show speculative positioning. When non-commercial traders are heavily net long, it sometimes precedes a correction—because momentum chasers pile in late. On the flip side, too much pessimism among speculators or record bearish positioning might set the stage for a rebound.

Meanwhile, fund flows into gold ETFs (like GLD, IAU) provide a visible gauge of demand. Consistent inflows suggest investors are allocating more to gold, reinforcing bullish setups. Interestingly, positive investor sentiment often aligns with macro tailwinds, but could also act as a contrarian signal if it peaks too quickly.

In practice, a savvy observer blends technicals with sentiment—watching chart breakouts, momentum, ETF flows, and positioning for confirming signals—not chasing every uptick, nor dismissing subtle warning signs.

Real-World Examples: From 2020 to Present

The Pandemic Surge

Remember early 2020? Markets tumbled, central banks slashed rates, and gold rocketed from about $1,500 to $2,050 by mid-2020. That rally was turbocharged by a mix of fear, stimulus, and liquidity flooding the system. Gold responded dramatically—simple as that.

Mid-2022 to 2023 Resilience

Fast forward: when rate hikes swept through in 2022–2023, gold initially faltered. But despite higher yields, it held within a range, even managing mini rallies when rate expectations softened. That showed gold’s resilience—if inflation stays sticky or rate-cut whispers grow louder, gold can still catch upward winds.

Recent Consolidation and Anticipation

Entering 2025, gold hovered around the $1,900–$2,000 corridor. Price action was indecisive, as markets awaited clarity on inflation, Federal Reserve guidance, and geopolitical risk. It was almost like everyone leaned forward, waiting for a cue.

That context makes the current question—”Can gold reach new record highs?”—not just theoretical, but pressing. We want to watch whether conditions align: sticky inflation, dovish pivot, or fresh shocks could rekindle a run. But if the macro cools, or real yields remain elevated, gold might trace sideways or even retreat modestly.

Forecasting Scenarios: Scholars’ and Analysts’ Take

Bull Case: Breakout to New Highs

- Trigger: Persistent inflation above target, continued central bank easing.

- Chart confirmation: A clean breakout above $2,050 with volume support.

- Investor catalyst: Renewed ETF inflows, oversold revert in speculative reports.

In this scenario, gold could flirt with $2,100–$2,200 in medium term, unless derailed by rising yields or rate hawkishness.

Base Case: Range-Bound Drift

- Trigger: Inflation cools modestly, but rates hold steady.

- Price action: Gold remains stuck between $1,900–$2,050.

- Sentiment: Neutral flows and balanced positioning.

This is plausible, especially if economic data steadies and uncertainty fades—gold could consolidate until fresh impetus arrives.

Bear Case: Pullback Pressure

- Trigger: Strong economic rebound, real yields spike, rates stay tight.

- Chart signals: Breakdown below $1,900, momentum rolls over.

- Sentiment: Specs pare back long positions; ETF outflows rise.

In that scenario, gold might dip toward $1,800 or lower, depending on how persistent yield pressure is.

Blending Frameworks: A Strategic Outlook

Mixed Signals Call for Flexible Planning

It may be tempting to pick one scenario and ride it out, but the reality is often messier—signals conflict, sentiment shifts, and unexpected shocks appear. So a nimble stance works better:

- Tactical allocation: Trim exposure if gold breaks higher on thin momentum; add if breakout consolidates with volume.

- Use of derivatives: Options like calls or protective puts can hedge bets—though obviously with costs and complexity.

- Multi-asset context: Evaluate gold relative to other hedges such as inflation-linked bonds or defensive equities.

Incorporating Macro Watchpoints

Keep an eye on:

- Core inflation readings and under-the-surface trends (like wage growth).

- Fed and central bank commentary—are they leaning dovish or still hawkish?

- Geopolitical developments—sanctions, conflicts, or supply disruptions.

- Market volatility across asset classes (e.g., VIX), which often lifts gold.

A Human Realization: Timing Matters

There’s always an urge—”Why didn’t I buy gold at $1,900?” or “If only I’d sold at $2,050.” The truth: successful positioning often hinges on discipline, not perfect timing. Understanding that small missteps are part of the process helps you focus on consistency, not regret.

Expert Insight

“In periods of elevated risk and policy uncertainty, gold tends to reclaim its place among the most trusted safe-haven assets—though its trajectory depends critically on real yields and investor sentiment aligning.”

This perspective—drawn from commentary by veteran commodities analysts—underscores the conditional nature of gold’s performance: it’s not just about crisis, but how market participants perceive value amidst turbulence.

Narrative Moments: Real-Life Analogies

Imagine two investors:

Investor A loads up on gold early in 2020 at $1,500, banks a tidy gain by mid-2020 when gold peaks above $2,000—but then exits too early amid fade. Frustrating short‑term, but still profitable.

Investor B watches too cautiously, only bids at $2,050 in 2021 when momentum peaked, and suffers a drawdown as gold retreats. Ultimately, missing the move hurts more than catching the peak.

These stories underscore that imperfect participation—with emotional ups and downs—is normal. High conviction is good; flexible execution is better.

Conclusion

Gold’s path toward new record highs remains plausible under certain conditions: persistent inflation, dovish central banks, or renewed geopolitical shocks could catalyze a breakout above the $2,050 mark. Yet, a base‑case range‑bound environment, or a reversal under economic optimism and rising real yields, is equally likely. The best approach blends multiple layers—technical signals, macro data, sentiment flow—combined with tactical flexibility and emotional discipline. In short, gold’s future isn’t pre‑written: it’s conditional, context‑driven, and demands both patient observation and decisive action when the setup emerges.

FAQs

What key factors could drive gold to reach new record highs?

Gold’s ascent typically depends on higher inflation, dovish policy shifts from central banks, and renewed safe‑haven demand amid geopolitical unrest. Watch for convergence of these conditions.

How reliable are technical signals in predicting gold’s breakout?

Technical patterns like triangle breakouts or momentum indicators offer context, but they are not foolproof. Confirmations via volume, market sentiment, and positioning make them more actionable.

Should retail investors use ETFs to gain exposure to potential gold rallies?

Yes, ETFs like GLD or IAU offer liquid and cost‑efficient exposure to gold. However, timing and conviction still matter—so blending with a strategic framework rather than emotional chasing is wise.

What are the risks if gold fails to sustain a rally above recent highs?

In that case, gold might drift in a familiar range or face downside pressure if real yields rise or inflation cools. A fallback toward $1,800–$1,900 is possible, especially if demand fades.

Can geopolitical shocks alone trigger a gold surge even if macroeconomic conditions are stable?

Absolutely. Geopolitical events sometimes catalyze sudden safe‑haven flows into gold. Even with stable growth and central bank policy, such shocks can momentarily override fundamentals.

How should investors manage emotional bias when charting gold strategies?

Acknowledging that hesitation and regret are normal helps. A disciplined, rules‑based approach—such as scaling entries/exits, using alerts, and reassessing setups regularly—can counteract emotional bias.

This article aimed to combine analytical depth, practical frameworks, and human unpredictability—all while keeping “Gold Price Prediction: Can Gold Reach New Record Highs?” grounded, actionable, and slightly conversational.

Leave a comment