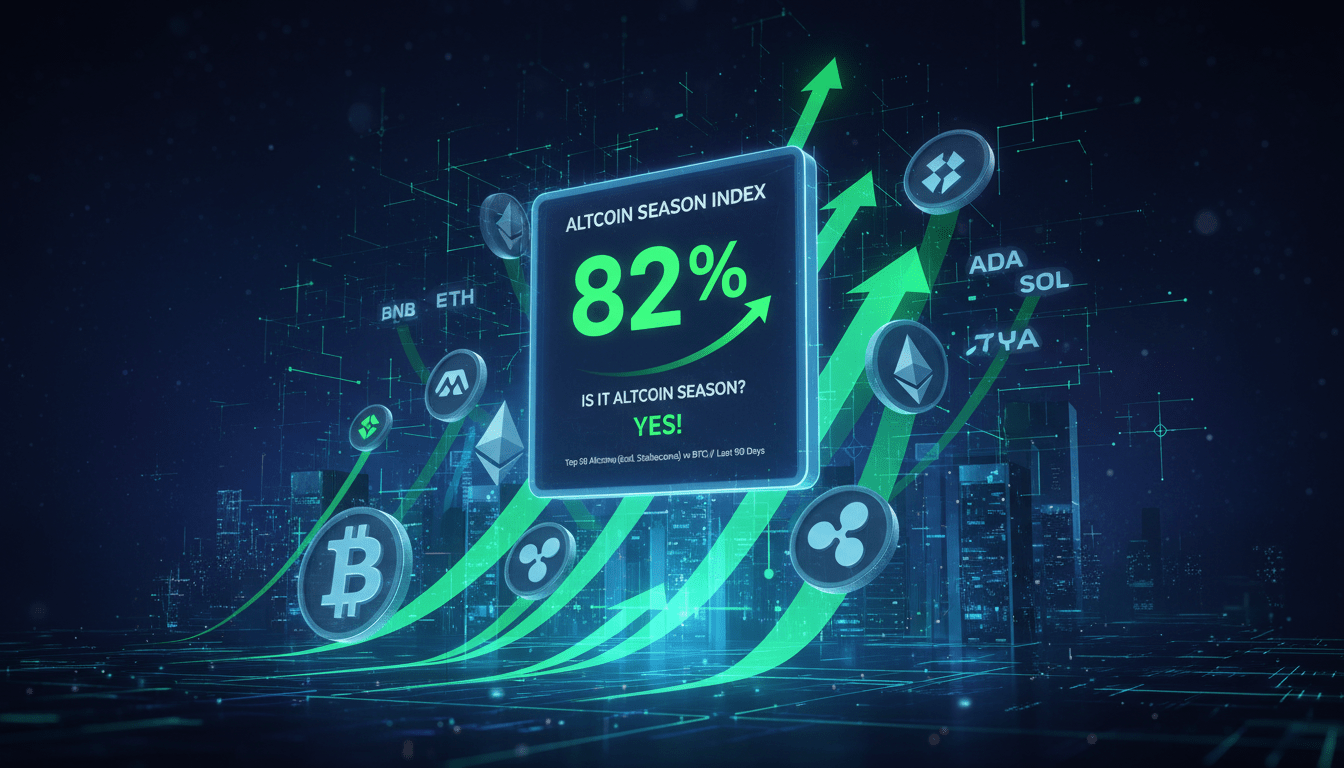

If you’re wondering whether we’re currently in “Altcoin Season,” the answer lies in the Altcoin Season Index (ASI)—a data-driven metric that measures how many top altcoins have outperformed Bitcoin over the past 90 days. Typically, a reading above 75 suggests an altcoin season, while anything below 25 indicates Bitcoin is dominating. As of recent updates, the index is hovering in the neutral range, not yet signaling a full altcoin season.

Understanding the Altcoin Season Index

The Altcoin Season Index serves as a heat map for market sentiment, showing how capital flows between altcoins and Bitcoin.

How It Works

- It tracks the top 50 or 100 altcoins, excluding stablecoins and wrapped tokens, and compares their 90-day performance with Bitcoin’s.

- The result is expressed as a percentage: how many altcoins outperformed BTC, scaled from 0 to 100.

What the Numbers Mean

| Range | Interpretation |

|————-|————————|

| 0–25 | Bitcoin Season (BTC leading) |

| 26–74 | Neutral or Transitional Phase |

| 75–100 | Altcoin Season (alts leading) |

These thresholds give traders a quick sense of relative market momentum.

Where to Find the Latest Index and What It Reveals

Several platforms publish real-time ASI readings using slightly different methodologies and data samples.

CoinMarketCap

CMC’s ASI tracks the top 100 altcoins against Bitcoin over 90 days, updating daily. A reading of 75 or higher triggers an “Altcoin Season” label, while 25 or lower signals “Bitcoin Season.”

As of mid-2025, CMC’s index ranged from the teens to low forties—far below the 75 threshold—indicating that while altcoins were gaining some traction, Bitcoin still maintained dominance.

Gate.io

Gate’s version follows a similar logic but might focus on the top 50 altcoins for its index. Like other providers, they map out ranges that correspond to Bitcoin Season, Neutral, and Altcoin Season.

Recent Readings & Market Context

- By late July 2025, the ASI had only climbed to around 43, up from a low of 16 in April—and still well within neutral territory.

- In mid-July, CoinDesk reported a reading of roughly 36, signaling early momentum but not yet an altcoin-driven market.

Overall, we’re seeing gradual movement toward altcoins, but none of the indexes currently confirm a full-fledged altcoin season.

Why the Altcoin Season Index Matters (and Its Limits)

Strengths of the Index

- Offers a clear, quantitative snapshot of capital rotation from Bitcoin to altcoins.

- Useful for adjusting portfolio strategy, especially when paired with complementary metrics like Bitcoin dominance or on-chain volume.

Limitations to Watch

- Lagging nature: based on past 90-day performance, it can’t predict upcoming shifts.

- Sample bias: if only a few large-cap altcoins rally, they can inflate the index—even if many others lag.

- Methodological inconsistencies: different platforms include different coins, timeframes, and data sources.

- Lack of narrative context: the index doesn’t explain the “why” behind altcoin gains.

Real-World Examples and Current Trends

2025 Market Movements

- While ASI remained under 50, pockets of altcoin strength were still visible. For instance, layer-1 tokens such as SUI (+36%), SEI (+41%), and ETH (+23.3%) led gains. Meme coin dominance was waning in favor of utility-driven projects.

- Bitcoin’s consolidation around key levels (e.g., ~$112,000) provided a staging ground for altcoin rallies—though nothing yet reached full blown altseason.

Investor Sentiment and Macro Signals

- Declines in Bitcoin dominance, while not drastic, did suggest rotating capital flow toward altcoins. ASI in the low 40s signaled early stages of renewed interest.

- Factors like Bitcoin ETFs, macro liquidity, and institutional narratives around Ethereum infrastructure boosted altcoin appeal.

Strategic Tips for Traders Using the Altcoin Season Index

How to React Based on Current Signals

- If ASI drifts toward the 50–75 range, consider scaling into high-conviction large or mid-cap altcoins.

- Only above 75 does pure alt investment (across broader small-cap themes) make more sense.

Recommended Tactics

- View the ASI as part of a toolkit: always cross-reference with Bitcoin dominance charts, volume, narrative strength, and technical setups.

- Use it to time rotations, not as a sole signal. For instance:

- At ~50: Begin cautiously shifting exposure

- Above 75: Full tilt into alt-heavy exposure (if other conditions align)

- Rapid rollovers: Lock profits or tighten risk controls

Use Cases in Practice

- A trader might deploy 20% into alts at a 50 crossing, then add more as the index climbs.

- Another may use a drop from 85 to protect gains across alt positions.

- Always expect “false starts”: markets can spike above 75 only to revert—a reminder to manage risk.

Conclusion

The Altcoin Season Index remains one of the clearest signals for gauging market rotation, yet it’s not shouting “Altcoin Season”—far from it. Current readings linger in the neutral band, suggesting that while altcoins are gaining attention, Bitcoin still leads. For investors seeking opportunities, this moment may present a window to prepare—but not to overcommit. Pair the ASI with broader indicators and confirm strength through narrative, on-chain data, and price action.

FAQs

Is Altcoin Season happening right now?

No. Recent readings of the Altcoin Season Index fall in the neutral range (roughly 40–50), well below the 75 threshold typically required to call an “Altcoin Season.”

What values define Altcoin Season vs Bitcoin Season?

An ASI reading above 75 indicates Altcoin Season; 0–25 suggests Bitcoin Season; 26–74 is considered a neutral or transitional phase.

Can I rely on the ASI for trading signals?

It’s a useful context indicator, but not a lone predictor. It reflects past performance and should be paired with technical signals, macro narratives, and risk controls.

What limitations should I be aware of with the ASI?

The ASI is lagging by design. A small group of high-fliers can skew the index, and methodology varies between platforms. It doesn’t explain why altcoins are outperforming—only that they are.

Why do platforms use top 50 or top 100 altcoins in the index?

This is meant to capture a broad yet manageable cross-section of the market. More coins offer a broader picture, while fewer might skew toward large-cap behavior.

How can I use the ASI to time my portfolio allocation?

Start easing into altcoins around the 50 mark if other indicators align, increase exposure as the index climbs, and prepare defensive actions if it rolls over—especially after sustaining levels above 75.

Leave a comment