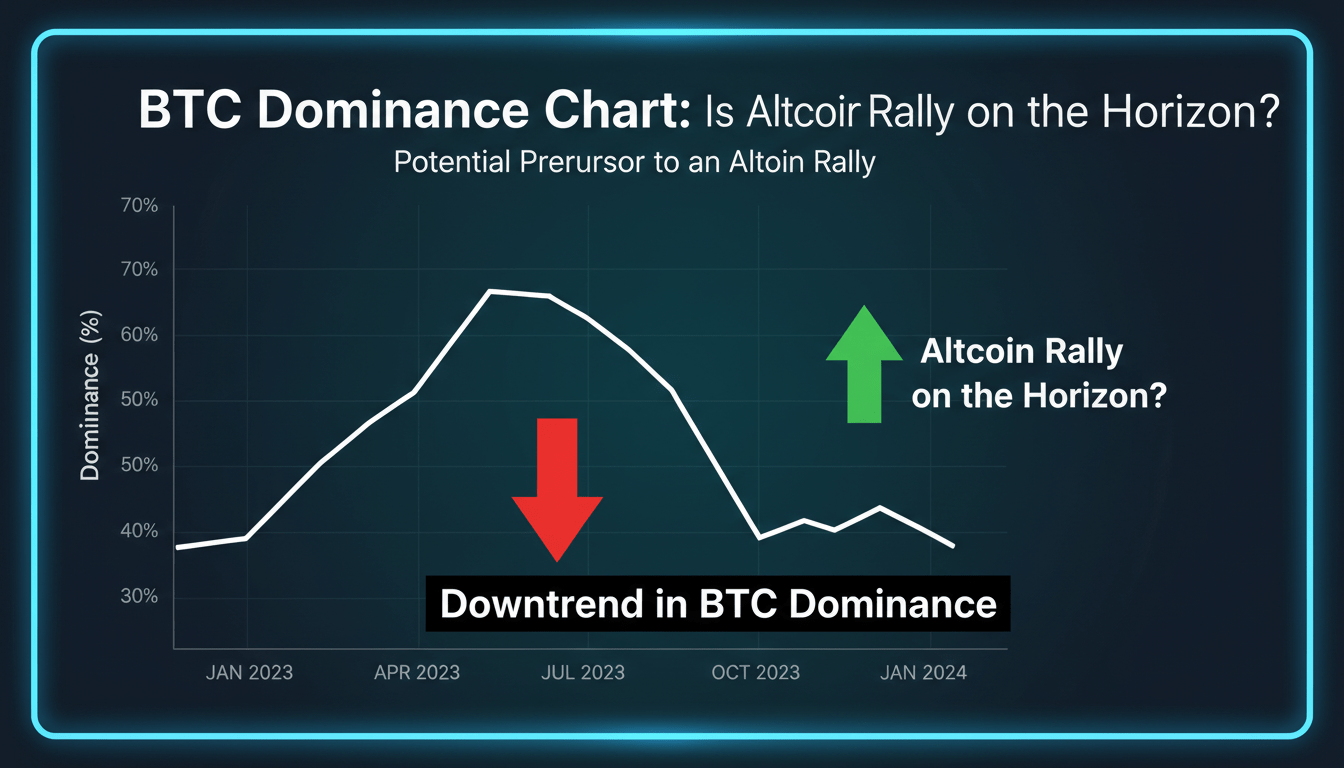

The BTC Dominance Chart—measuring the proportion of total crypto market cap held by Bitcoin—offers a direct signal for capital flow trends: when dominance falls, altcoins often gain attention; when it rises, Bitcoin tends to monopolize market strength. Right now (early February 2026), analysts are seeing Bitcoin dominance stuck near key resistance levels around 60%, setting the stage for a potential—but cautious—altcoin resurgence this year.

Understanding BTC Dominance and Its Relevance to Altcoin Cycles

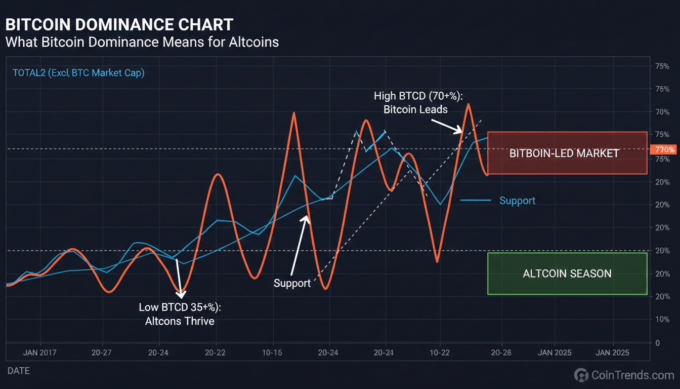

Bitcoin dominance (BTC.D) gives a snapshot of how capital is distributed across the crypto market. Historically, when BTC.D peaks and begins to fall, altcoins start to attract more investment—enter altseason. Patterns from previous cycles (like 2017 and 2021) confirm this recurring narrative: Bitcoin dominance peaks, retreats, and altcoins rally in its wake .

Currently, BTC.D is hovering near 60%, a zone of heavy resistance. Analysts warn this could go either way: a breakdown might signal renewed interest in altcoins, while a sustained hold could prolong Bitcoin’s dominance .

Recent Developments in BTC Dominance: What’s the Technical Picture?

Resistance Around 60%—Altcoin Pressure Cooker

Bitcoin dominance frequently tests the 59–60% band. Multiple rejections suggest sellers are defending this zone, hinting at imminent weakness . On-chain charts and MACD indicators show early signs of a golden cross in the altcoin sections—another signal that altcoins might gather steam in early 2026 .

Divergence in Sentiment: Analysts Split

Some, like Tony Severino, argue Bitcoin dominance is still too elevated—RSIs on weekly/monthly frames remain overbought, meaning altcoins may remain suppressed unless BTC.D falls below key levels . On the flip side, KuCoin analysts note that ETH/BTC is rebounding from support and the altcoin season index shows upward momentum, even if it isn’t in the altseason zone just yet .

A Potential Altseason Timeline for 2026

Early January Buzz: Mini Altcoin Season Shape-Up

Late December setups suggested that early January 2026 could see a minor altseason. Analysts flagged technical formations like triple bearish patterns on BTC.D and said rotation may start between January 5–12 as trading volume and liquidity return post-holidays .

Beyond January: Altseason 3.0 on the Horizon?

Following these early signals, market watchers point to a larger altcoin cycle, potentially Altseason 3.0. The ETH/BTC ratio is climbing, BTC.D shows early breakdown signs, and altcoin indices are slowly rising from lows—echoing the 2017 and 2021 cycles .

“Historical cycles indicate that altseasons came after BTC dominance peaks in 2017 and 2021.” — KuCoin analysts .

Still, the Altcoin Season Index remains below 75—the threshold typically required to confirm an altseason—suggesting that, while the groundwork is being laid, widespread altcoin leadership hasn’t yet arrived .

Macro Backdrop and Liquidity: The Outside Tailwinds

Beyond charts, broader economic signals are in favor of altcoins. Improved liquidity—stemming from easing interest rates and renewed retail and institutional participation—is seen as supportive for risk-on assets like altcoins .

Moreover, projections from some analysts suggest that Bitcoin dominance may peak in late 2025 and begin declining as risk heats up, especially if they follow four-year cycles tied to Bitcoin’s halving timeline . This aligns with narrative shifts placing Ethereum and other alts at the forefront once BTC dominance decline becomes tangible.

Narrative Snippets: What Traders Are Saying

- Reddit sentiment underscores a cautious optimism. One user wrote: “Bitcoin dominance dropped from 66% to 58%—alts are starting to outperform.” Meanwhile, others note that past cycles show altseasons often follow such declines .

- Another comment highlighted technical signals: “ETH/BTC ratio bottoming and BTC.D topping around 60–61%—this mirrors late 2020,” indicating potential shifts ahead .

- A third perspective suggested a multiplier effect despite broader caution: “Despite Bitcoin still holding strength, early signs among large altcoins point to selective strength rather than a universal breakout.” This echoes current chart readings .

Bringing It Together: What’s Next?

Scenario A: Altseason Ignites (If BTC.D Breaks Lower)

- BTC.D slips below 58%

- Momentum shifts into altcoins

- ETH/BTC continues rising

- Traders rotate capital into select altcoins for gains

Scenario B: Bitcoin Holds, Altcoins Wait

- BTC.D consolidates near resistance

- RSI remains overbought

- Altcoin performance remains patchy

- Market continues BTC-led momentum

Conclusion

Bitcoin dominance sits at a critical crossroads—hovering near resistance below 60%, showing signs of weakening but not yet collapsing. Technical cues, cycle history, and improving macro liquidity are aligning to hint at a possible altcoin rally through early to mid-2026. Although a full-fledged altseason hasn’t arrived, strategic rotation—probably led by ETH and other large-cap alts—is increasingly plausible. While the groundwork is laid, confirmation will come only if BTC.D convincingly breaks downward, altcoin indices cross into breakout zones, and macro signals remain supportive.

FAQs

What exactly is BTC Dominance, and why does it matter?

Bitcoin dominance (BTC.D) measures Bitcoin’s share of the overall crypto market cap. When it declines, capital often moves into altcoins, signaling potential altcoin strength and vice versa.

How does ETH/BTC support the altseason narrative?

The ETH/BTC ratio showing strength suggests that Ethereum is gaining value relative to Bitcoin. Historically, this precedes broader altcoin rallies, as ETH often leads the charge.

Is there evidence altseason has started yet?

Not fully. While early signs emerged around early January 2026, the Altcoin Season Index remains below trigger levels, indicating that broad market participation is not yet unfolding.

Which timeline looks most plausible for an altcoin rally?

Early to mid-2026 seems most plausible if BTC.D begins a sustained decline and macro conditions remain supportive. A mini-altseason may already have spiked in January, but broader momentum is still building.

Can altcoins rally if BTC continues to dominate?

Yes, but it’s likely to be selective. High-beta altcoins may outperform in tight rotation, but a full altseason requires broader BTC dominance weakness and strong altcoin participation.

How should investors interpret these signals?

Use BTC.D, ETH/BTC, and altcoin indices as directional indicators. Combine technical analysis with macro themes (like liquidity and institutional flows) to assess when to rotate capital into altcoins.

Leave a comment