Bitcoin ETFs have hit the headlines today as the market grapples with extreme volatility—marked by sharp sell-offs, ETF outflows, and a broader crypto market downturn. In short: Bitcoin-linked ETFs are tumbling hard alongside the broader slide in Bitcoin prices, sparking fresh concern among investors about sentiment-driven contagion across digital assets.

Current Market Turmoil and ETF Fallout

Bitcoin has plunged sharply, erasing much of its post-election gains. Price has broken key levels from late 2025, registering a fall to the low-$60,000 range. This marks roughly a 50% decline from its peak near $126,000 in October 2025 .

Coinciding with the crypto slump, Bitcoin ETFs recorded their steepest one-day drops in over a year. The iShares Bitcoin Trust (IBIT) plunged more than 13%, triggering substantial investor outflows . Across major funds—IBIT, Fidelity’s FBTC, and Grayscale’s GBTC—cumulative losses and outflows grew increasingly painful, with Fidelity shedding $900 million and GBTC $575 million so far in 2026 .

ETF Outflows and Broader Sentiment Shift

The early 2026 momentum from ETF inflows has reversed dramatically. Funds that had seen billions pouring in during the first two trading days—over $1.2 billion—are now facing a sharp exodus . Most disturbingly, since mid-January, Bitcoin spot ETFs have recorded outflows totaling approximately $2.9 billion, equivalent to a staggering $243 million in average daily withdrawals .

This abrupt reversal has amplified fears in the market. Derivatives data show traders hedging for further downside, and the elevated demand for puts signals well-entrenched “extreme fear” among investors .

Interconnectedness: Tech Stocks, Macro Risks, and Liquidity Squeeze

The crypto correction is not occurring in isolation. It’s unfolding alongside a broader sell-off in tech and AI equities. Bitcoin’s collapse is being underscored by faltering performance in key tech names like Alphabet and Qualcomm, as well as disappointments in earnings across the sector .

Simultaneously, forced liquidations stemming from leveraged positions in futures—sometimes tied to collateralized metals trading—have exacerbated the crypto downturn, tightening liquidity and accelerating ETF de-risking .

Institutional Response and Structural Risk

Even large institutional players are feeling the heat. Strategy Inc.—formerly MicroStrategy—briefly saw its Bitcoin holdings dip below average purchase cost due to the price slide. Still, with solid debt coverage and no immediate maturities, the near-term financial strain is manageable .

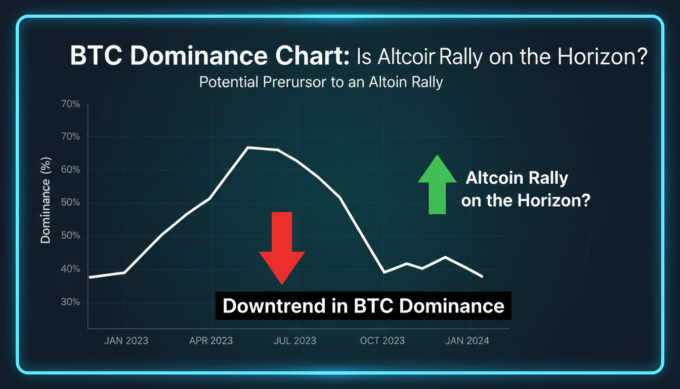

However, at the systemic level, the rapid rise and fall of ETF inflows signal a fragile foundation. Back in 2024–2025, Bitcoin ETFs amassed nearly $60 billion in assets, fueling explosive price gains. Now, with outflows mounting, ETFs may be accelerating the sell-off just as they previously boosted the rally .

Expert Insight

“This ETF-driven flip from accumulation to mass exodus reflects how sentiment, not fundamentals, often governs crypto markets. When fear sets in, liquidity vanishes fast.”

This underscores a critical risk: Bitcoin ETFs provide accessibility—but that accessibility can become a vulnerability when investor mood shifts.

Looking Ahead: Warning Signs and Potential Recovery Triggers

With February underway, several turning points could unfold:

– A stabilization or reversal in ETF flows could signal investor return and relief;

– Technical and regulatory catalysts—such as progress on crypto market structure bills—might buoy sentiment ;

– Institutional participation, especially from knowledge-heavy infrastructure players, could underpin a more resilient market.

Conclusion

The present Bitcoin ETF situation is a tale of volatility—momentum-fueled inflows followed by deep fear-driven outflows. Bitcoin prices have plummeted, pulling ETFs down in their wake, while broader tech sector weakness and forced liquidations have deepened the rout. The key to any turnaround lies in sentiment stabilization, institutional confidence, and regulatory clarity. Without these, the ETF redemption cycle may continue to drive prices lower.

FAQs

What exactly triggered the sudden ETF sell-off in February 2026?

A combination of sharply falling Bitcoin prices, tech sector headwinds, and forced liquidation from leveraged positions created a cascading, sentiment-driven exodus from Bitcoin ETFs.

How much have ETFs lost in outflows recently?

Since mid-January, US-listed Bitcoin spot ETFs have seen approximately $2.9 billion in outflows, averaging around $243 million withdrawn per day .

Is this ETF pullback affecting only retail investors?

Not at all—both retail and institutional players are exiting, as ETFs have democratized access and now serve as shock conduits for markets when fear spikes.

Could ETF outflows push Bitcoin further down?

Yes. ETFs amplify both bullish inflows and bearish outflows; large redemption waves can accelerate price declines even more than initial drops.

What might stop the bleeding and reverse the trend?

A return of ETF inflows, positive regulatory developments, or renewed institutional engagement could help reverse market sentiment and stabilize prices.

Leave a comment