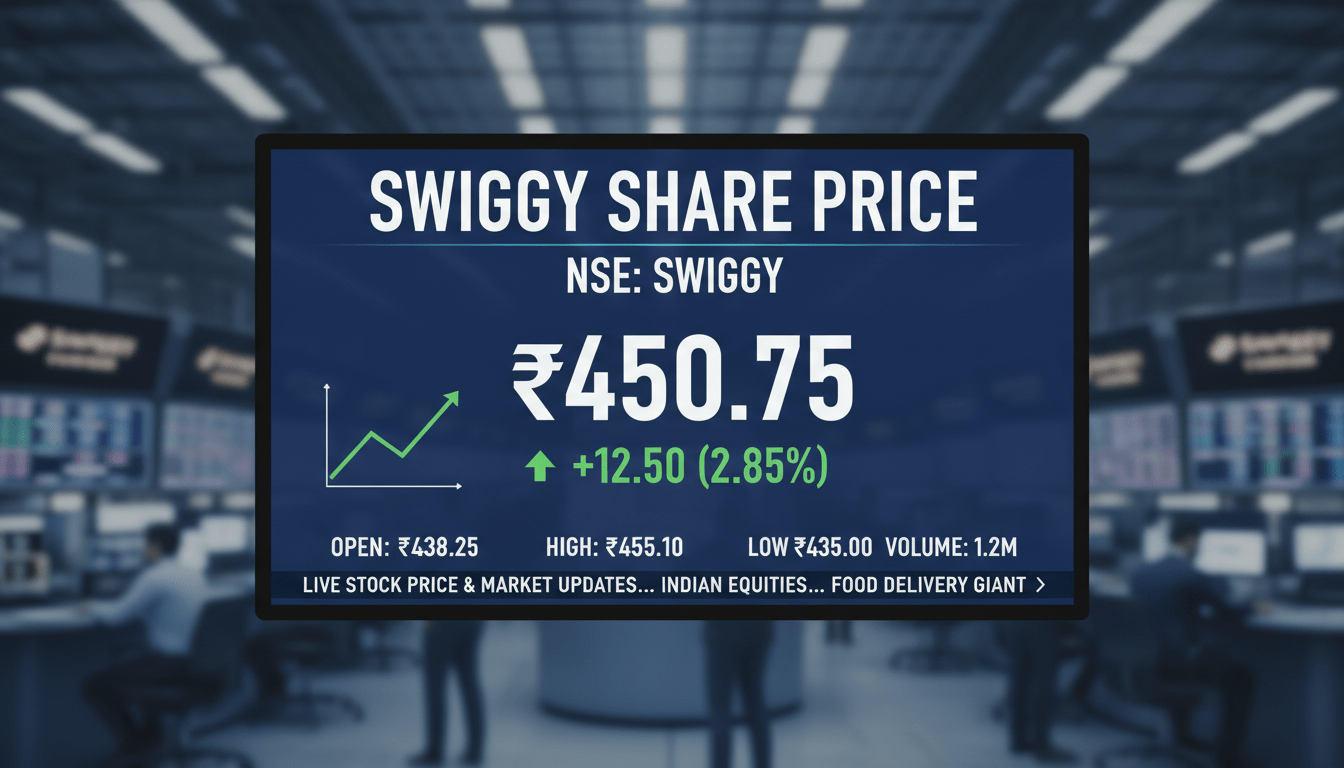

Swiggy’s share price on the NSE is approximately ₹319–₹320 as of early February 2026, trading within a 52-week range of ₹297–₹474 and a market capitalization near ₹88,300 crore. The stock shows negative P/E ratios and persistent quarterly losses, while revenue continues to grow. Let’s dive deeper.

Current Share Price Snapshot

Swiggy’s stock closed at around ₹320 on February 6, 2026, down slightly from its previous close—₹319.80 recorded by Business Standard and ₹319.40 noted by Economic Times . Volume figures hovered around 2.2 lakh shares (Business Standard) and over 61 lakh shares (Economic Times) , suggesting moderate trading activity.

Key Technical and Financial Metrics

- Market Cap: ₹88,300–₹88,330 crore

- P/E Ratio (TTM): Approximately –19.9

- EPS (Trailing Twelve Months): Negative, around –₹16

- PB Ratio: Ranges between 4.46 and 8.68 depending on source

- 52-week High/Low: ₹474 / ₹297

These metrics reflect a business still in the red, where earnings remain negative but scale and valuation remain elevated.

Historical Listing and Market Reaction

Swiggy listed on the NSE on November 13, 2024, at ₹420—roughly an 8% premium over the IPO price of ₹390 . Initial enthusiasm drove the stock to as high as ₹449 intraday, touching a market cap around ₹1 lakh crore .

Despite the strong debut, sentiment cooled as losses mounted and profitability remained elusive. Institutional investors and analysts tempered expectations, leading to downgrades and strategic caution .

Financial Performance vs. Market Sentiment

Revenue Growth vs. Losses

Swiggy continues to expand revenue—its Q1 FY26 topline surged 54% YoY to ₹4,961 crore—but losses widened significantly, nearly doubling from ₹611 crore to ₹1,197 crore . This suggests vibrant demand but mounting pressure on margins.

In FY24, the company recorded losses totaling a few thousand crores, even as it picked up steam in food delivery and quick commerce . Efforts to scale fast, such as expanding dark store networks, eat into profitability but fortify future growth.

Analyst Sentiment & Fundraising Pressure

Brokerages have taken varied stances. Motilal Oswal sees upside and strengthened the stock’s rating to “Buy,” with a near-certain 32% upside to a ₹560 target based on improving sector dynamics . Conversely, JM Financial downgraded Swiggy to “Reduce,” citing an urgent need for a $500 million fundraise and flagging funding risks .

What This All Means – A Quick Overview

| Dimension | Insight Summary |

|————————|———————————————-|

| Share Price | ₹319–₹320 in early Feb 2026 |

| Valuation | Market cap ~₹88,300 crore |

| Profitability | Persistent losses, negative P/E (~–20) |

| Financial Highlights | Revenue growing; profitability lagging |

| Analyst Views | Mixed—some bullish, some cautious |

| Risks & Catalysts | Fundraising needs, competition, scaling costs |

Expert Insight

“Swiggy is scaling impressively, but without a clear profitability roadmap, investor confidence will remain cautious. Growth alone isn’t enough—margin discipline and capital efficiency will be deciding factors.”

— Industry Analyst

Conclusion

Swiggy’s current NSE share price of ₹319–₹320 reflects an enterprise in a high-growth phase, still burning cash but expanding aggressively in quick commerce. The journey ahead hinges on navigating funding needs, managing losses, and turning scale into sustainable profitability.

FAQs

What is Swiggy’s current share price on NSE?

As of early February 2026, Swiggy trades around ₹319–₹320.

How does Swiggy’s valuation stack up?

The market cap is approximately ₹88,300 crore, but the company isn’t profitable yet.

Is Swiggy profitable?

No. Swiggy is posting losses and sports a negative P/E ratio (~–20).

Have analysts given useful targets?

Yes. Motilal Oswal sees potential upside to ₹560, while JM Financial cautions, suggesting a “Reduce” rating.

What’s driving Swiggy’s stock movement?

Revenue growth is strong, but investors worry about continued losses, competitive pressure, and the need for new fundraises.

Should I invest in Swiggy now?

That depends on your risk tolerance. If you’re betting on growth and future profitability, there’s potential. But if safety and immediate returns matter, caution may be wiser.

Leave a comment