Today’s top technology business news is anchored by strategic infrastructure decisions, AI-driven shifts, and feature-rich product rollouts across the digital landscape. Companies are doubling down on AI—even as spending strains supply chains—WhatsApp is expanding functionality, chipmakers are advancing performance, and investors are recalibrating exposure. This snapshot delivers clarity on what matters now.

AI Spending Surge and Its Ripple Effects

Corporate giants are backing up bold moves with even bolder budgets. Amazon recently unveiled a massive $200 billion AI infrastructure plan for 2026—ramming up spending well ahead of projections for competitors like Alphabet and Meta, and sparking market jitters given past overreach echoes.

Meanwhile, the AI boom isn’t just about chips and cloud. A mounting body of analysis warns that this frenetic investment is triggering supply chain strains—from mobile device chip shortages to labor and construction pressure in data center builds. The concern? Routine business and innovation may get crowded out by infrastructure bloat.

Beyond hardware, firms are modernizing networks to prep for both current AI demands and the looming quantum threat. Legacy infrastructure is now seen as a bottleneck—and potentially a security liability—as businesses race to keep pace.

Why it matters: These spending trends reflect high-stakes bets on AI’s transformative potential—and the infrastructure push raises questions about sustainability, priority, and long-term ROI.

Corporate and Tech Moves: From Social Apps to Silicon

On the product side, WhatsApp has rolled out video and voice calling on its web app—bridging desktop and mobile platforms for a smoother user experience.

In hardware, Qualcomm’s upcoming Snapdragon 8 Elite Gen 6 (and Gen 6 Pro) chips—manufactured on TSMC’s N2P node—promise blazing performance with LPDDR6 support, positioned for premium flagships.

Gaming gear is also getting attention: Ayaneo’s Next II Windows handheld arrives at nearly four pounds and a hefty $4,300 price tag, signaling a niche but serious push for ultra-premium portable gaming.

Meanwhile, Bluesky, a smaller social network, quietly addressed user needs by adding a much-requested drafts feature—catching up with rivals X and Threads.

Why it matters: Feature rollouts and hardware launches show innovation is still vibrant—from social platforms to ultra-high-end gadgets. Yet user experience and premium engineering remain dominant themes.

Investor Sentiment and Market Movements

Tech investors are growing cautious around AI’s juggernaut. In Australia, the storytelling goes: “everyone blames Claude,” referring to investor nervousness around Anthropic’s AI platform as share prices slip and strategies shift.

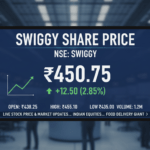

Delivery-tech stocks offer a counterpoint: Eternal’s shares rose 6% to a 12-week high, while Swiggy gained 5%—indicating bullish sentiment in logistics and delivery infrastructure.

At a broader level, markets are tuning in to earnings, CPI data, and fortunes of big tech. The Dow surged past 50,000 thanks to gains from Apple, Boeing, and AI infrastructure plays like Nvidia and TSMC. Yet the Nasdaq lagged, reminding investors the tech rally is still cautious and uneven.

Why it matters: Investor behavior reflects momentary confidence in infrastructure plays, yet broader caution remains. AI bets are under scrutiny, making diversification and selectivity smarter moves.

Shifting Tech Trends: Edge, Agentic AI, and Infrastructure Strategy

Beyond headlines, long-term analysis reveals tech is evolving on several fronts:

- Agentic AI & Autonomous Systems: These aren’t just futuristic concepts—they’re shaping up as “virtual coworkers” capable of planning and executing multistep workflows.

- Edge Innovation & Hybrid Cloud: Businesses are pushing compute to the periphery. 5G, multicloud, and low-code tools are expanding access while reducing latency.

- Regional Tech Competition: Nation-states and corporations are investing in sovereign infrastructure—from local chip fabs to quantum labs—to reduce geopolitical exposure and drive innovation.

Why it matters: Flexibility, resilience, and distributed intelligence are emerging as pillars for sustainable growth—far beyond headline AI hype.

“To fully harness AI’s potential, organizations must modernize infrastructure, unify cloud and edge connectivity, and prepare ahead for quantum threats.”

— TechRadar analysis

Conclusion

Technology business news today reveals a tech landscape shaped by bold AI bets, infrastructure friction, nuanced investor sentiment, and emerging models of autonomy and edge computing. Bold moves—like Amazon’s AI spending—are balancing on tightropes of supply constraints and investor anxiety. At the same time, innovation thrives in hardware, feature enhancements, and long-term infrastructure shifts.

Strategic takeaways:

- Watch how AI spending translates into performance—both operational and financial.

- Consider diversifying into edge-ready, infrastructure-bolstering industries like semiconductors and delivery tech.

- Don’t ignore the political and supply risks tied to AI acceleration and data center expansion.

FAQs

Q: Why are tech giants spending so much on AI infrastructure now?

They’re betting AI will deliver transformative gains—but heavy investment also reflects the arms race for compute, talent, and capacity.

Q: How are AI investments straining the economy?

Rising demand for chips, construction labor, and data-center infrastructure is contributing to shortages, delays, and cost increases across sectors.

Q: What is agentic AI and why does it matter for business?

Agentic AI refers to intelligent systems capable of autonomously planning and acting—adding value as “virtual coworkers” rather than simple tools.

Q: Should investors be cautious about AI-focused stocks?

Yes—selectivity matters. While infrastructure firms show promise, cautious investing is warranted amid broad uncertainty and potential overspending.

Q: How are software companies addressing quantum security risks?

Many are modernizing networks, boosting cybersecurity, and exploring quantum-safe encryption now to prepare for future threats.

Q: What innovation trends lie beyond AI?

Edge computing, hybrid cloud strategies, sovereign infrastructure development, and low-code platforms are driving distributed, resilient innovation.

Leave a comment