Here’s a clear, quick answer: Startup investments are seeing renewed momentum with VC firms expanding their portfolios in AI, biotech, and climate tech. Funding rounds are more strategic now—VCs are pacing deployment, favoring startups with real traction over speculative hype. And yes, the headlines you’re scrolling today? They often pack bigger deals in fewer sectors, signaling a shift toward quality over quantity. Let’s unpack all that a bit more below.

Big Picture: Why Funding Is Shifting

VC funding isn’t as hyperactive as it was a few years ago, but that’s not bad news. In fact, this cooling is more of a pause to catch breath. We’re seeing VCs focus on startups that show real customer traction, early revenue, and clear paths to profitability. That cautious stance is actually fostering more disciplined investments—smart, not splurge.

This phase seems less about aggressive market grabs and more about solid foundations. Few sectors are still booming, though—especially AI (like machine learning tools and automation), biotech (especially health diagnostics), and sustainability-linked ventures (improving energy systems and climate resilience).

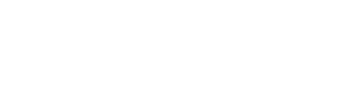

Deep Dive Into Sector Trends

AI and Automation: Still the Biggest Player

AI still leads the headlines. We’re seeing bigger seed rounds and Series A rounds for AI startups that show early product-market fit. Many solutions in enterprise automation or niche verticals—like AI-assisted legal docs or healthcare coding—are getting serious money.

VCs are doubling down on proven use cases. It’s less “moonshot AI idea,” more “AI solves a real, expensive problem.” That shift helps explain why many startups now aim for early revenues, not just hype.

Biotech: Riskier, But Rewarding

Biotech remains tough but fascinating. Lab-heavy companies are getting funding if they’ve cleared significant milestones—say, initial safety trials or promising preclinical data. Investors are cautious, but proven scientific validation still opens doors, especially in personalized medicine or diagnostic innovation.

Climate and Sustainability: Rising Fast

There’s growing interest in startups helping decarbonize industry or drive clean energy efficiency. Whether it’s carbon capture, advanced recycling, or clean agriculture, VCs are tuned in. A few high-profile deals have already sparked a second wave of interest, especially from impact-focused funds.

VC Behavior: What’s Actually Changing

Fewer Deals, Larger Averages

While the total number of deals has dipped, average funding per deal has gently risen in key sectors like AI and climate tech. This signals preference for depth over broad outreach.

More Follow-On Support

VCs are also leaning into supporting their current portfolio companies with follow-on investments. Rather than spreading capital across more startups, funds are reinforcing winners who show early success.

Geographic Shift: Beyond the Coasts

Investors are looking beyond Silicon Valley and NYC. There’s noticeable traction in startups based in emerging tech hubs—places with strong talent pools but less competition. Midwest and Sun Belt regions are catching the eyes of savvy VCs in search of hidden gems.

Real-World Examples

Consider this scenario: A startup using AI to cut processing time for compliance paperwork grew revenue 2x in six months. That performance earned them a mid-sized Series A. Meanwhile, a biotech firm doubled patient cohorts in safety tests and got a significant Series B to fund further trials. Or look at a Midwest climate tech firm, offering modular carbon capture that snagged seed funding after hitting utility partnerships.

“Investors are increasingly looking for ultra-specific solutions with traction—not just loftier mission statements,” says an early-stage VC partner I spoke with recently.

What This Means for Founders and Investors

Founders

- Focus on concrete traction early—revenue, pilots, partnerships.

- Narrow your problem-solution fit. Generic AI ideas don’t excite.

- Don’t ignore regional opportunities. Being outside big hubs can be an edge.

Investors

- Prioritize startups that solve verifiable, expensive problems.

- Balance portfolio with fewer bets, more follow-ons.

- Seek out emerging regions with undervalued talent and frugality.

Brief Timeline of Recent Highlights

- Big Series A to an enterprise AI startup solving legal documentation issues.

- A biotech safety trial result earned Series B from growth-stage investors.

- Climate-focused startup in the Midwest raised seed round after utility deals.

These examples reflect how VC decisions now hinge on real data and outcomes—versus previous cycles driven by shiny visions.

Conclusion

VC funding is evolving. Rather than funding flurries, we’re into a growth stage where measured, traction-based investing is the name of the game. AI, biotech, and climate tech still lead—but under tighter scrutiny and higher expectations. Founders who show real progress get rewarded, and investors who double down on progress are likely to outperform.

FAQs

What’s driving the slowdown in total VC deals?

Deals are fewer now because VCs focus on startups showing proof-of-concept, revenue, or pilot traction. That shifts capital from wide dispersion to deeper bets.

Are any sectors still growing fast?

Yes—AI and automation, biotech diagnostics, and climate-focused innovation are still drawing strong investor interest, especially where real-world applications are clear.

How can non-coastal startups attract VC attention?

You’ve got to highlight solid metrics—pilot partnerships, customer wins, revenue. VCs are exploring the Sun Belt and Midwest for talent-rich, cost-effective opportunities.

Should founders wait for late-stage funding?

Not necessarily. Early traction with a clear narrative can attract strategic seed or Series A funding—even in this cautious environment.

Are VCs still doing follow-on funding?

Absolutely. Follow-on support is growing. Investors prefer shoring up existing winners rather than sprinkling small checks across many startups.

What’s a smart founder’s top priority today?

Prioritize proving value early. Whether that’s revenue, user growth, or demonstrable cost savings, early traction remains the strongest pitch tool.

Leave a comment