Here’s the quick answer: Enterprise software is being reshaped by AI-driven disruption, heightened cybersecurity risks, shifting investor sentiment, and major platform innovations. Stocks are swinging, valuations are resetting, and companies are racing to adapt—or risk being left behind.

Industry Snapshot – What’s Driving the Headlines (≈200 words)

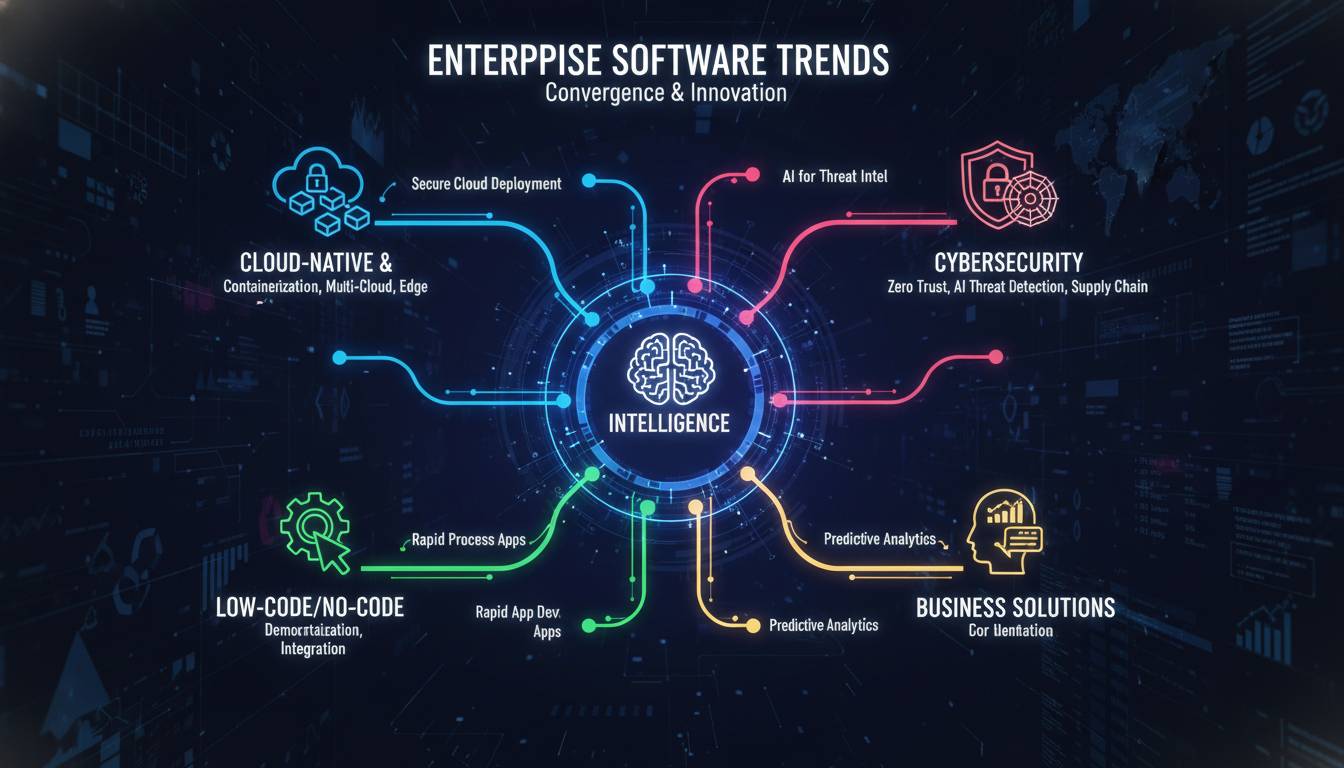

Enterprise software is seeing seismic shifts right now. AI integration—especially autonomous or “agentic” systems—is transforming product design, pricing, and go-to-market models. At the same time, cybersecurity threats are rising, with active exploits reported in key developer tools and enterprise platforms. Investor sentiment is volatile; valuations have plunged and sector stocks have been hit hard. But renewed investor interest in value and compliance-focused firms suggests a potential rebound. Meanwhile, strategic partnerships and platform rollouts are accelerating AI adoption across the enterprise.

1. AI Is Reshaping How Software Is Built and Sold

AI isn’t just another feature—it’s rewriting the playbook. Autonomous models and generative AI are embedded in everyday enterprise tools. The result? Conversational interfaces are fast becoming the default, and AI agents are automating workflows once done by humans .

AlixPartners projects that traditional enterprise software models will unravel in 2026. They expect M&A activity to soar 30–40% (approaching $600 billion in deals) as mid-market firms struggle to compete without major AI transformation .

A key prediction: Usage- and outcome-based pricing will surge, making up around 40% of revenue, replacing per-seat subscriptions entirely. Investors are shifting to value metrics tied to efficiency and results .

“AI is redefining what customers value, how companies capture it, and what investors reward.” — Giacomo Cantu, AlixPartners

2. Valuations Slide and Stocks Swing on AI Fears

The cloud isn’t just raining uncertainty—it’s flooding valuations.

Enterprise software P/E ratios have collapsed—down from roughly 39x to 21x in just a few months—the biggest drop since the dot-com crash . That’s a brutal reset, driven by fears over AI supplanting traditional models.

SAP’s guidance of slightly slower cloud growth triggered a sector-wide crash in January. Stocks like ServiceNow fell 13%, Salesforce dropped 7%, and Workday slipped 8%—even though fundamentals looked solid .

Yet the bleeding may be easing. On February 9, software stocks rebounded as institutional investors saw buying opportunities. Bentley Systems climbed around 3.2%, while Teradata gained 2.9% .

3. Cybersecurity Threats: Active Exploits in Enterprise Tools

Security isn’t just a checkbox—it’s the frontline. The U.S. Cybersecurity and Infrastructure Security Agency (CISA) confirmed active exploits of critical vulnerabilities affecting tools like Versa, Zimbra, Vite, and Prettier. These are developer staples, and their compromise raises serious risk across supply chains .

In parallel, firms integrating agentic AI must rebuild their security frameworks from the ground up. Vendors promising airtight “Trust Infrastructure” will likely pull ahead .

4. AI Platform Rollouts and Strategic Moves

On the innovation front, several major players unveiled noteworthy initiatives:

-

OpenAI’s “Frontier”: A new enterprise platform to build, host, and manage AI agents integrated with systems like CRM and data warehouses. Early adopters include Intuit, State Farm, Thermo Fisher, and Uber .

-

Snowflake & OpenAI: A $200 million deal to embed AI agents directly into Snowflake’s data platform, enabling natural language operations across cloud environments. Canva and WHOOP are early users .

These moves are shifting AI from experimental to mission-critical across enterprise stacks.

5. Tech Spending Soars, Fueling Enterprise Software Demand

IT budgets are rebounding—and AI is leading the charge. Global tech spending is projected to reach $6.15 trillion in 2026, up over 10% from last year. Software spending alone is expected to grow by 15%, while generative AI sees explosive growth at more than 80% year-over-year .

In Europe, tech investment is robust, with EU governments and enterprises ramping up AI and R&D spending—especially in finance and healthcare .

Conclusion

Enterprise software today stands at a crossroads. AI is dismantling old paradigms—from how we build software to how we price and secure it. Stock performance mirrors the chaos: big drops followed by tentative rebounds. Security threats loom, making trust a key differentiator. And innovation momentum is real, powered by game-changing platforms from OpenAI, Snowflake, and others.

For industry leaders, the mandate is clear: embrace AI transformation, strengthen trust and compliance, and recalibrate business models for outcome-based value. And for investors, look beyond panic—seek firms grounded in governance, AI ethics, and operational agility.

FAQs

What’s causing the plunge in enterprise software valuations?

A mix of AI-driven disruption fears and uncertainty around long-standing business models—like per-seat licensing—has triggered the sharpest valuation drop since 2002, as investors re-evaluate revenue stability .

How soon will AI agents become common in enterprise workflows?

OpenAI’s Frontier and Snowflake’s AI integrations suggest we’re seeing early institutional adoption now. Broader rollout is likely through 2026, as confidence in governance and productivity gains grows .

Are enterprise software stocks still a risky bet?

Volatility remains. Stocks slumped on AI fears and soft guidance in early 2026, but some recovery is underway as investors eye firms with strong compliance and long sales cycles .

What makes some software vendors more appealing right now?

Firms investing in AI trust infrastructure—security, privacy, auditability—and those enabling usage- or outcomes-based pricing models are seen as future-ready and more resilient .

Is global enterprise tech investment rising?

Yes. IT spending is surging—expected to hit $6.15 trillion globally in 2026—with software growth at 15%, generative AI over 80%, and strong momentum across cloud and cybersecurity .

How big is enterprise software expected to get long-term?

The market is projected to grow from around $257 billion in 2025 to over $643 billion by 2033, benefiting from cloud adoption, automation, and AI integration .