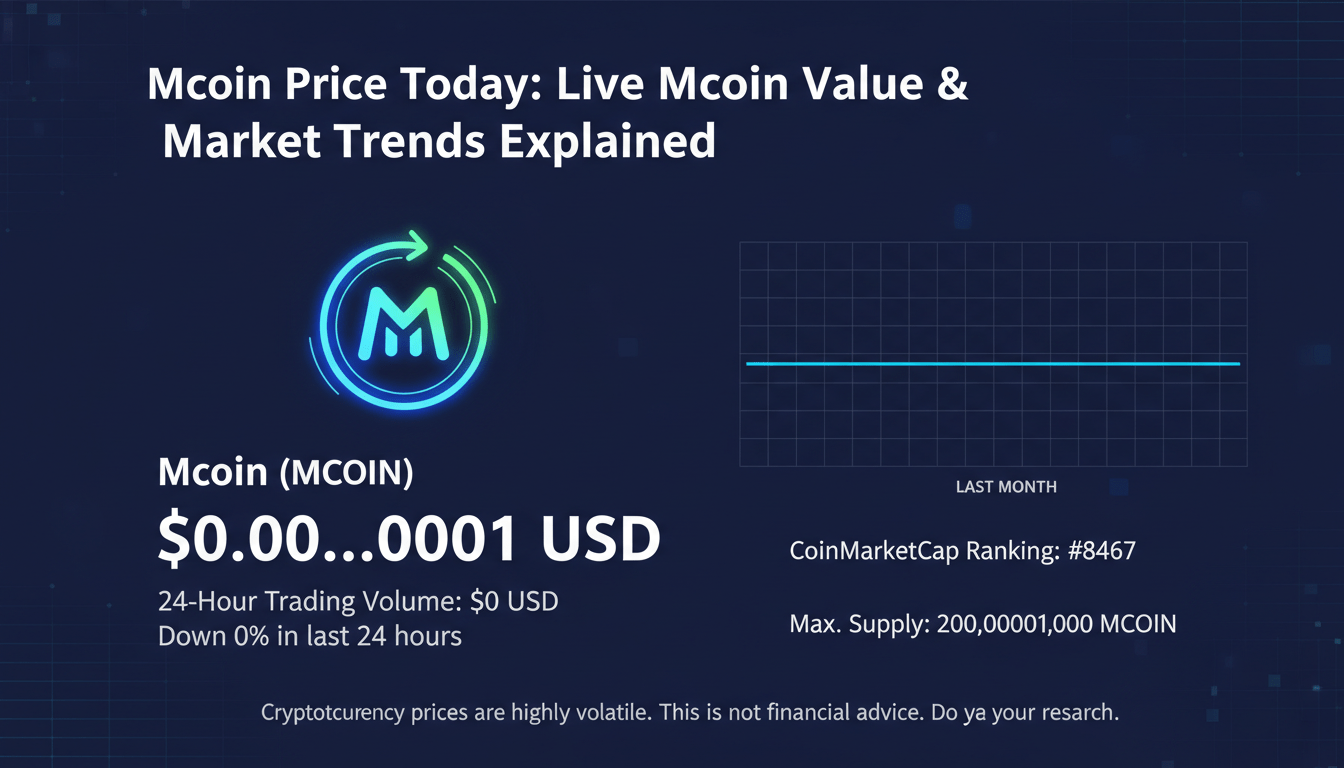

Mcoin is trading at approximately $0.04366, experiencing a modest lift from the previous close. Today’s price range saw an intraday high near $0.04385 and a low around $0.03884 citeturn0finance0turn0finance1.

Understanding Mcoin’s Current Market Behavior

Overview of Price Point

At around $0.0437, Mcoin remains a relatively low-priced token, yet it gains attention for its market fluctuations and speculative appeal citeturn0finance0turn0finance1. Rising from yesterday’s levels, it’s capturing subtle bullish interest—even if still under the radar compared to major cryptocurrencies.

Volatility & Day Trading Dynamics

With intraday movement between $0.0388 and $0.0438, Mcoin shows intraday volatility of roughly 12%. That’s a decent swing, appealing to nimble traders but less comforting to long-term holders.

Broader Market Context & Trends

Short-Term Technical Outlook

Looking ahead, CoinCodex predicts a gradual dip in the coming days: around –3.5% by March 8, 2026, and potentially –24.7% over six months, falling toward $0.03015 . This algorithmic model hints at a bearish trajectory, though of course real-world shifts could bend that trend.

Forecast from Alternative Model

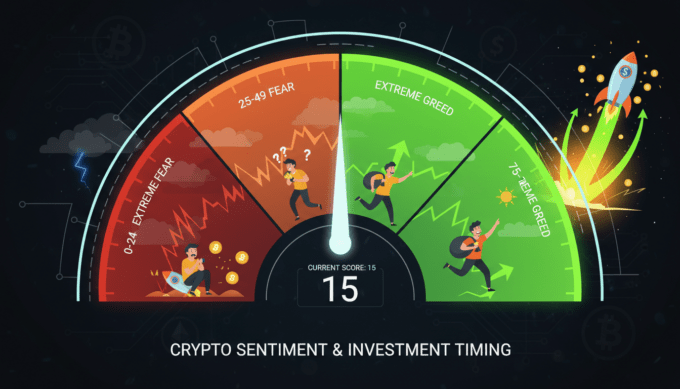

Meanwhile, Coincheckup’s analysis paints a slightly less gloomy picture, projecting a decline to $0.0535 by December 16, 2025—a fallback rather than a collapse—with low sentiment readings including a Fear & Greed Index of 10 (Extremely fearful) and price volatility of ~7.6% .

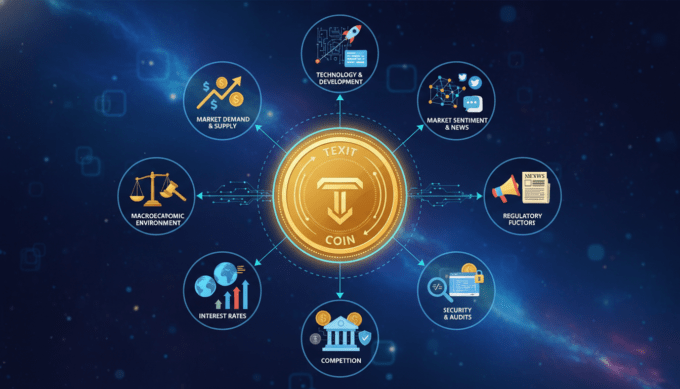

What’s Driving Mcoin’s Movement?

Fundamental Use Cases

Mcoin functions as the native token of the M20 Chain, fueling smart contracts, payments, and governance roles within that ecosystem . This gives it functional utility beyond meme status.

Market Sentiment & Supply Factors

With a total supply capped at 500 million tokens and roughly 177 million circulating today, Mcoin’s supply dynamics suggest potential for upward pressure if demand increases . Yet sentiment remains fragile, and broader crypto markets continue to test investor nerve.

Expert Insight into Price Behavior

“When a cryptocurrency trades under a nickel, even minor shifts in investor appetite or token listings can trigger pronounced volatility.”

This captures the precarious balance Mcoin operates in—where modest demand or news can produce outsized price swings.

Summary of Key Price Metrics

| Metric | Value |

|———————————-|——————————-|

| Current Price | ~ $0.04366 |

| Intraday Range | $0.0388 – $0.0438 |

| Short-Term Forecast (CoinCodex) | ~ $0.0386 by March 8, 2026 |

| Medium-Term Forecast (CoinCodex) | ~ $0.03015 in six months |

| End-2025 Estimate (Coincheckup) | ~ $0.0535 |

| Supply & Demand Notes | 177M circulating of 500M max |

| Use Case | Utility token for M20 Chain |

What This Means for Investors & Traders

For Active Traders

Today’s volatility offers opportunities—those watching short-term charts might navigate quick rebounds. Still, be ready for sudden slumps: the model-based outlooks show broader downside risk.

For Long-Term Holders

Given functional utility via the M20 Chain, long-term holders may want to stay engaged—especially if ecosystem growth occurs—even though current signals lean cautious.

Conclusion

Mcoin is currently trading near $0.0437, with intraday volatility offering active traders potential moves. Short-term projections suggest a mild decline, while medium-range forecasts foresee a deeper dip toward $0.03. The token’s role within the M20 Chain gives it intrinsic utility, yet sentiment remains thin and speculative. Smart investors should balance technical modeling with real-world developments in the M20 ecosystem.

FAQs

What is Mcoin’s price today?

Mcoin is trading at about $0.04366, with intraday highs near $0.04385 and lows around $0.03884 citeturn0finance0turn0finance1.

What do short-term forecasts say about Mcoin’s direction?

CoinCodex predicts a modest dip of around –3.5% by early March 2026, potentially falling closer to $0.0386 .

Are there any optimistic projections?

Yes—Coincheckup forecasts a rise to $0.0535 by late 2025, assuming sentiment improves slightly .

Why does Mcoin’s supply matter?

With 177 million tokens circulating out of a maximum 500 million, limited supply can amplify price moves if demand shifts .

What is Mcoin used for?

It’s a utility token powering the M20 Chain, enabling smart contracts, payments, and governance within that ecosystem .

Leave a comment