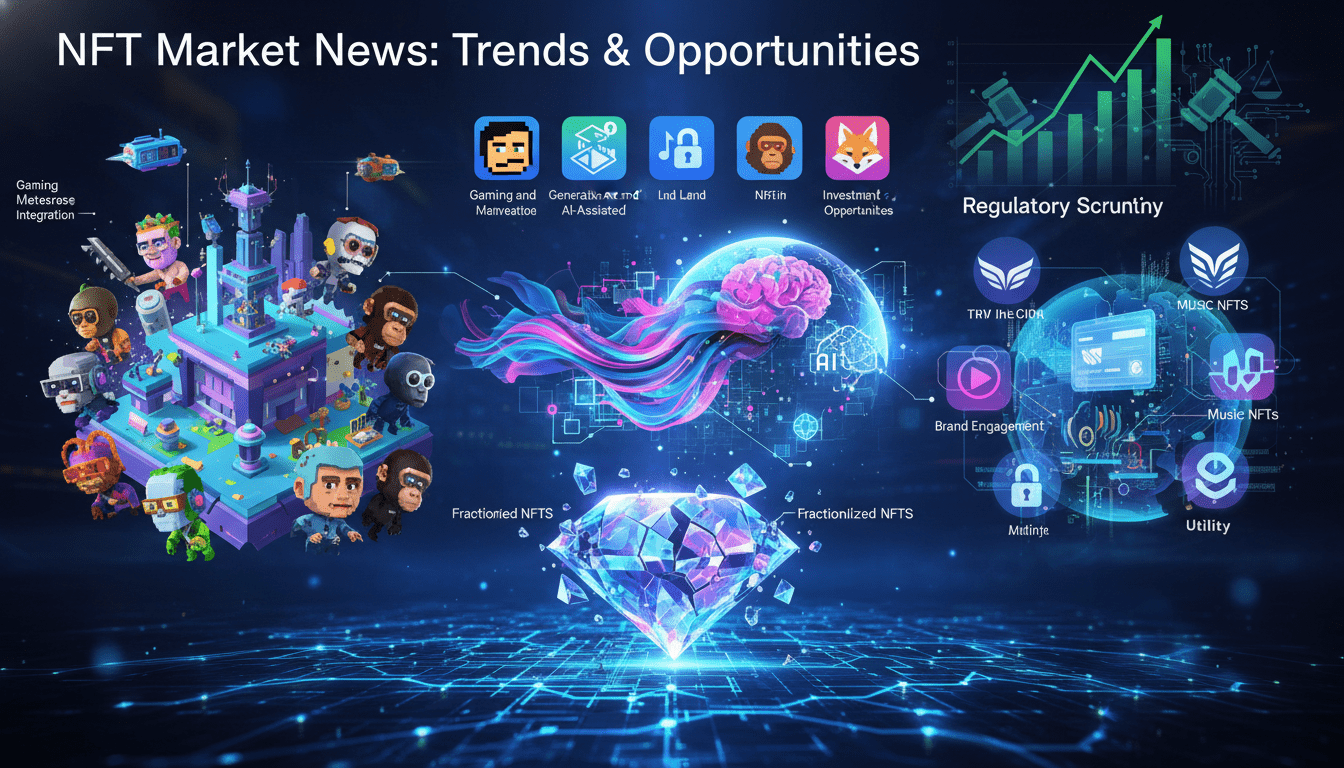

The NFT market has rapidly evolved into a dynamic landscape of emerging trends and investment opportunities, making it a relevant and sometimes perplexing space for investors and creators alike. Recent months have seen growing interest in utility-driven NFTs, fractional ownership models, and cross-platform interoperability—all pointing toward a maturing ecosystem. Whether you’re an early adopter or a cautious investor, insights into current developments can help you make sense of where value is actually moving and where it might not. So—cutting to the chase—NFT market news shows growing momentum around utility, fractionalization, and creator-led platforms, offering fresh angles for long-term opportunity, amid typical volatility that comes with speculative assets.

Market Momentum: Shifts in Utility and Beyond

Utility Comes into Focus

The days of purely collectible JPEGs seem to be too simplistic now. The market is increasingly embracing NFTs with tangible utility—things like membership tokens that grant access to exclusive content, event tickets, or even revenue-sharing rights. This shift mirrors consumer appetite for more than art alone; people want function and value, not just a picture. Many platforms now tout token-gated communities or benefits that extend beyond blockchain bragging rights.

Fractional Ownership Trending Upward

Beyond utility, fractionalization—where a single high-value NFT is split into multiple ownership shares—has emerged as a compelling trend. It democratizes access to high-end digital assets, who might not be able to afford an entire Bored Ape, for instance, but would invest in a fraction. This mechanism both expands market participation and adds liquidity, a boon for renditions that were previously illiquid. Still, wrapping and custodian risks remain, reminding us this isn’t risk-free.

Interoperability & Cross-Platform Momentum

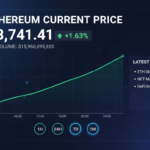

On the technical side, NFT interoperability—how easily a token moves across chains or platforms—is gaining traction. Layer 2 solutions, sidechains, and bridges are making it more seamless to transfer NFTs between networks like Ethereum, Polygon, Solana, or emerging layer 2s. This flexibility encourages wider distribution and utility, potentially reducing gas pain for users and unlocking new audiences.

Investment Opportunities in Today’s NFT Market

High-Utility Collections

Collectors and investors are gravitating toward NFTs tied to real-world perks or digital services. For instance, projects offering early access to drops, discounts on physical merchandise, or voting rights in platform governance are increasingly sought-after. These utility-rich NFTs tend to retain a base value even when broader market sentiment cools.

Blue-Chip and Mid-Tier Collections

While early speculative plays might’ve dominated headlines, blue-chip collections—those with established rarity, community, and liquidity—remain steady. Think of iconic series that still trade strongly, offering relative safety amidst volatility. Mid-tier projects with strong teams and roadmaps are also drawing more savvy investors, looking to catch next-level growth before it hits mainstream price tags.

Play-to-Earn and Metaverse NFTs

Game-centric NFTs, particularly those tied to metaverse ecosystems or play-to-earn models, continue to attract attention. They often come bundled with in-game items or land, which can appreciate as game economies grow. Though market swings affect them, they offer more structured utility via gameplay or ecosystem engagement.

Emerging Artist-Driven Drops

Independent creators are leaning on NFTs for alternative revenue streams and community-building. Limited drops by emerging creators—especially those integrated with IRL or virtual events—have sparked meaningful buzz and traction. These opportunities are less about resale hype and more about investing in creative voices with potential.

Striking Opportunities: Case Examples

The “Token-Gated Membership” Model

A Web3 art collective recently launched a membership NFT letting holders access online studio tours, exclusive prints, and community discussions. As demand grew, the membership token’s value held steady despite broader market dips. It’s an example of blending tangible benefits with collectible appeal, and community insiders say it’s a model that could be replicable in other verticals like music or education.

Fractionalized “Digital Real Estate”

Another experiment involved a high-value digital land parcel in a popular metaverse, fractionalized across 100 tokens. Holders now share in any leasing income and future appreciation. This approach turned what was previously a speculative behemoth into an accessible, income-generating asset—though legal and custodial layers require careful navigation.

Gaming-Gated NFTs Gaining Traction

One P2E project introduced weapon NFTs that upgraded with gameplay, offering holders a sense of exclusivity and progression. Trades surged not just for their scarcity but for the in-game advantage they provided. Gamers say it’s a compelling blend of treasury play and tangible gameplay benefit.

Risks and Considerations: Read The Fine Print

Volatility and Liquidity Challenges

NFT valuations remain notoriously volatile. Prices can swing dramatically based on hype cycles, celebrity involvement, or broader crypto sentiment. Liquidity can dry up fast when interest fades, locking in losses for some holders—especially in mid-tier or speculative assets.

Custody, Smart Contract, and Legal Risks

Fractional and utility NFTs may rely on smart contracts, custodial entities, or wrapped mechanisms. Each adds complexity—and potential failure points. A fractionation contract could malfunction, or terms might change around royalties or benefits. Plus, legal frameworks around digital securities and fractional ownership are still evolving.

Regulatory Uncertainty

Governments are eyeballing NFTs through lenses of licenses, intellectual property, and even security classification. Utility tokens with dividend-like structures or fractional ownership models may draw regulatory scrutiny—especially if benefits mimic profit-sharing or access rights. It’s wise to stay informed on evolving rules in your jurisdiction.

Strategic Entry Framework for NFT Investors

1. Define Your Primary Goal

Clarify your intent—are you after exposure to creator ecosystems, utility gains, long-term collectible appreciation, or in-game assets? Your strategy should reflect whether you’re betting on technology, creative talent, comfort with market cycles, or enjoyment value.

2. Conduct Due Diligence

Research teams behind projects, check roadmap progress, community engagement (on Discord/Twitter/etc.), and smart contract audit status. Even small flags—like zero audits or anonymous founders—can amplify risk. Diverse metrics matter.

3. Evaluate Liquidity and Exit Strategy

Look up floor prices, trading volume, and resale pathways—OpenSea, Magic Eden, shaders, etc. Bigger Blue-Chip assets may offer easy exits, while niche or new drops could be harder to offload unless you ride hype.

4. Diversify Thoughtfully

Don’t stack just one genre. Consider mixing utility-driven tokens, blue-chip collectibles, mid-tier growth, and gaming/metaverse assets. That spread gives you exposure to multiple demand drivers. But keep allocation reasonable—NFTs should typically remain a small portion of a high-risk portfolio.

5. Stay Agile and Engage with Communities

Active communities often drop hints about future utility expansions or collaborations. Engage through social channels to gauge sentiment and insiders’ perceptions. Being plugged-in can help you react to shifts faster.

Expert Perspective

“NFTs are maturing beyond collector art—they’re becoming real access keys and ownership models with transaction utility. That’s what separates speculative bubbles from sustainable value creation.”

This perspective highlights that real value in NFTs is increasingly tied to functionality and ecosystem participation, not just rarity.

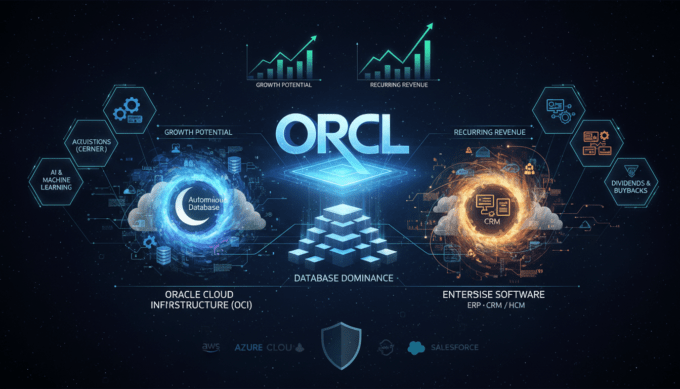

Broader Outlook: Mature Ecosystem, Selective Growth

The NFT ecosystem is on a trajectory toward maturation. Speculative surges may still happen, but long-term growth seems more dependent on utility, infrastructure, and creator communities. Platforms integrating meta trends like DeFi, gaming, and decentralized identity will likely lead the next wave.

However, that doesn’t mean easy wins anymore. Whether you’re here for play-to-earn yields, blue-chip exposure, or backing creative talent, thoughtful vetting and risk awareness matter now more than ever. NFTs are becoming an intricate asset class—not just pixel art speculation.

Conclusion

In sum, the current NFT market is shifting from hype-fueled speculation to a more structured ecosystem built around utility, fractional access, interoperability, and creator engagement. Investment opportunities now favor tokens with real-world or digital-use value, backed by engaged communities. That said, volatility, legal ambiguity, and custody complexities remain ever-present. A disciplined framework—grounded in clarity, research, diversification, and community engagement—can guide smarter entry into this evolving space.

FAQs

What defines a utility NFT?

Utility NFTs grant holders functional benefits beyond ownership—think access to exclusive content, event perks, governance rights, or real-world services.

How does fractional ownership of NFTs work?

Fractional NFT models split ownership via tokens, so multiple people can hold a share of a valuable asset. It boosts accessibility, but often involves extra smart contract or custodial risks.

Are gaming NFTs a good investment?

They can offer structured value through gameplay, upgrades, or ecosystem progression. However, their worth is often tied to the platform’s popularity and longevity—doing your research is crucial.

What risks should investors be aware of in NFTs?

Volatility, limited liquidity, smart contract flaws, custodial risks, and evolving regulatory landscapes are primary concerns to watch carefully.

How can someone start investing in NFTs sensibly?

Define clear goals, vet communities and teams, assess liquidity, diversify across types of NFTs, and engage with the space to stay informed and agile.

Leave a comment