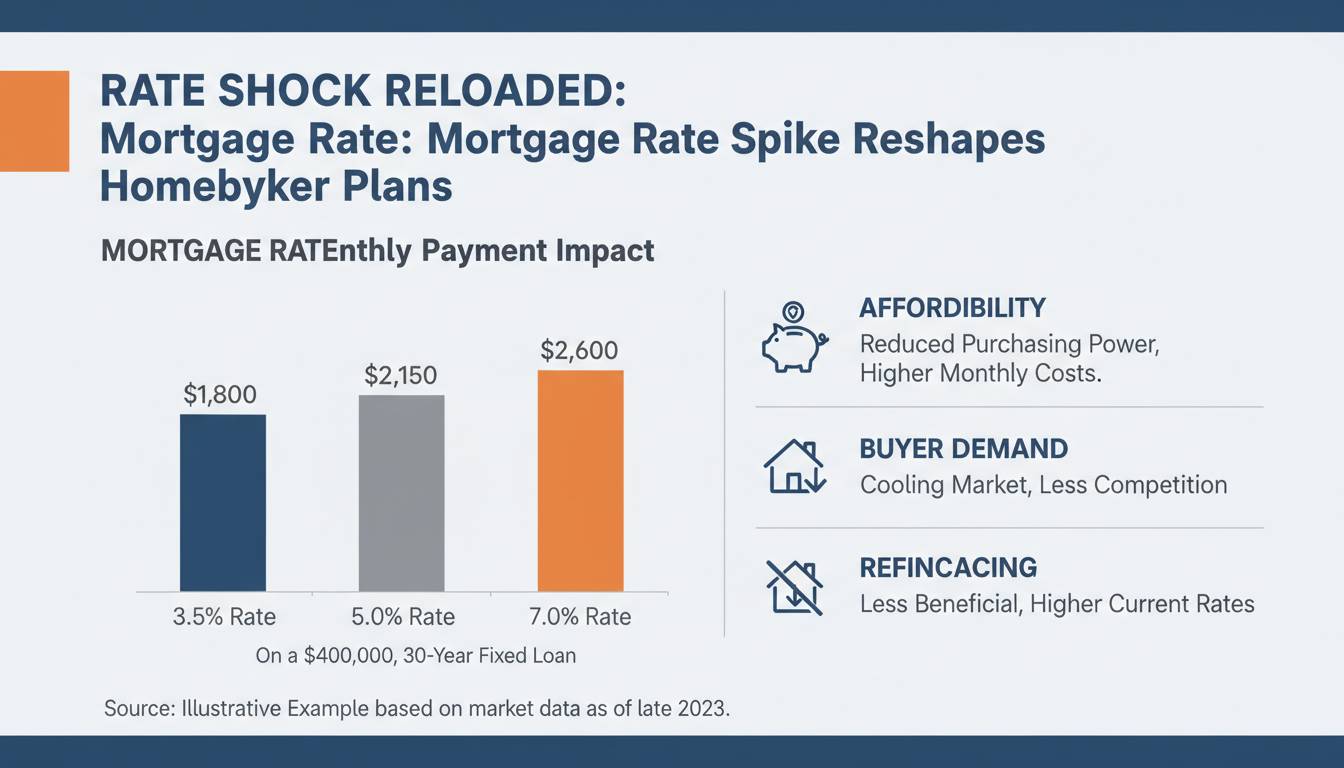

Homebuyers are adjusting fast as mortgage rates surge unexpectedly—what felt like a small rise now reshapes budgets, priorities, and timing. This “rate shock reloaded” flips housing plans by making affordability squeeze harder, pushing many toward adjustable-rate options, delaying purchases, or rethinking refinances. Let’s explore how today’s mortgage numbers are upending strategies—and what buyers and sellers are doing in response.

What “Rate Shock Reloaded” Means for Buyers

This isn’t your typical rate fluctuation. Suddenly seeing a jump into the mid- to high‑6% range—or even flirting with 7%—is jolting many would‑be buyers. That psychological barrier shifts decisions. When the 30‑year fixed rate crosses 7%, it can freeze buyers, especially first‑timers. In early 2025, that happened and buyers reined in activity despite slightly improving inventory .

Adjustable‑rate mortgages (ARMs) are suddenly more attractive. Their lower initial rates give buyers some breathing room. In recent spikes, ARM demand rose noticeably—hitting levels not seen in years .

Buyers Rethink Their Timing and Strategy

Shifting Toward ARMs and Alternatives

When fixed rates climb, ARMs become a fallback. Instead of locking into high fixed payments, buyers take lower rates now with plans to refinance or sell later. The ARM share in applications rose as affordability tightened .

Builders also feel the pinch. To keep transactions moving, over half started offering incentives like rate buydowns, temporary reductions in borrower interest, just to keep buyer attention .

Tighter Purchase Demand

Even as rates slightly dip, buyers don’t always jump in. In mid‑2025, rates cursorily fell below 7%, yet purchase applications stayed low amid broader economic uncertainty and housing inventory that was still stretched .

Buyers are cautious if they suspect rates will continue falling. Surveys later in 2025 found most expect further rate drops and are holding off, delaying purchases until conditions feel more favorable .

Real‑World Examples and Data Trends

Here’s a snapshot of how rate shifts influenced behavior:

- In early 2025, a big weekly drop in rates sparked a surge in refinance and purchase applications—refinances soared 37%, and homebuying rose too .

- But just weeks later, when rates edged higher—hovering around 6.9% for a 30‑year fixed—homebuyer applications slipped again, held back by uncertainty .

- One dramatic week saw refinance applications jump nearly 60% when rates dipped; ARMs rose to nearly 13% of all applications, the highest since 2008 .

- Conversely, when rates hit multi-month highs near 7%, purchase applications dropped significantly, reflecting affordability crunches .

“When mortgage rates break key levels, buyers either pounce or pause—that flip in sentiment is real.”

—Freddie Mac economist

What Sellers and Builders Are Doing

Builders are getting creative too. With buyer demand softening, they’re rolling out rate buydown offers—covering interest temporarily to reduce monthly payments and make homes more affordable in the short term .

Some sellers have cut asking prices to reinvigorate interest, especially after weeks or months of inactivity. Reports suggest March 2025 saw the most reductions since 2018 .

What’s Ahead: Strategy Under Rate Shock

For Buyers

- Consider ARMs if you believe rates will ease later—but understand the risks.

- Watch bond markets and Treasury yields—mortgage rates tend to follow.

- Build in flexibility: if rates fall, you may refinance—but if they rise, plan for the higher fixed cost.

For Sellers

- Incentivize with buydowns or price tweaks.

- Communicate the affordability calculations—buyers often react more to payment size than headline rates.

For Investors and Lenders

- Track the mortgage‑Treasury spread. Narrowing spreads can signal rate relief—even when Fed policy is steady .

- Monitor demand shifts closely; a small dip or rise in rates can swing refinancing and purchase behavior dramatically.

Conclusion

Rate shock isn’t a mild nudge—it resets housing plans overnight. Today’s spike into the mid‑6% or even 7%+ territory is pushing buyers to ARMs, making sellers offer creative incentives, and introducing a new wave of caution in purchase timing. The market is reacting swiftly—so flexibility, smart timing, and clear communication are key survival tools in today’s rate‑volatile environment.

FAQs

Why do small shifts in mortgage rates cause big changes in buyer behavior?

Even a 0.25% difference can alter monthly payments noticeably, pushing affordability past psychological thresholds. Buyers often react emotionally to rates near 7%, which are seen as costly.

Are ARMs a safe alternative when fixed rates spike?

They offer lower initial rates and flexibility, but only if buyers plan to refinance or move before rates reset. Holding an ARM long‑term in a rising rate environment can be risky.

What should sellers do when mortgage rates jump?

They can offer temporary rate buydowns or price adjustments to maintain buyer interest. Messaging around payment impact helps too.

How do mortgage rates relate to Treasury yields?

Mortgage rates often follow 10‑year Treasury yields. When yields rise due to inflation or uncertainty, lenders raise rates—even if the Fed hasn’t changed policy.

Will mortgage rates fall again soon?

It depends on economic data and bond market trends. Many expect further drops, but rates are influenced by inflation, bond activity, and Fed guidance.

What’s the mortgage‑Treasury spread, and why does it matter?

It’s the gap between mortgage rates and Treasury yields. When the spread narrows, mortgage rates can drop even when yields stay steady—offering hidden relief to buyers.