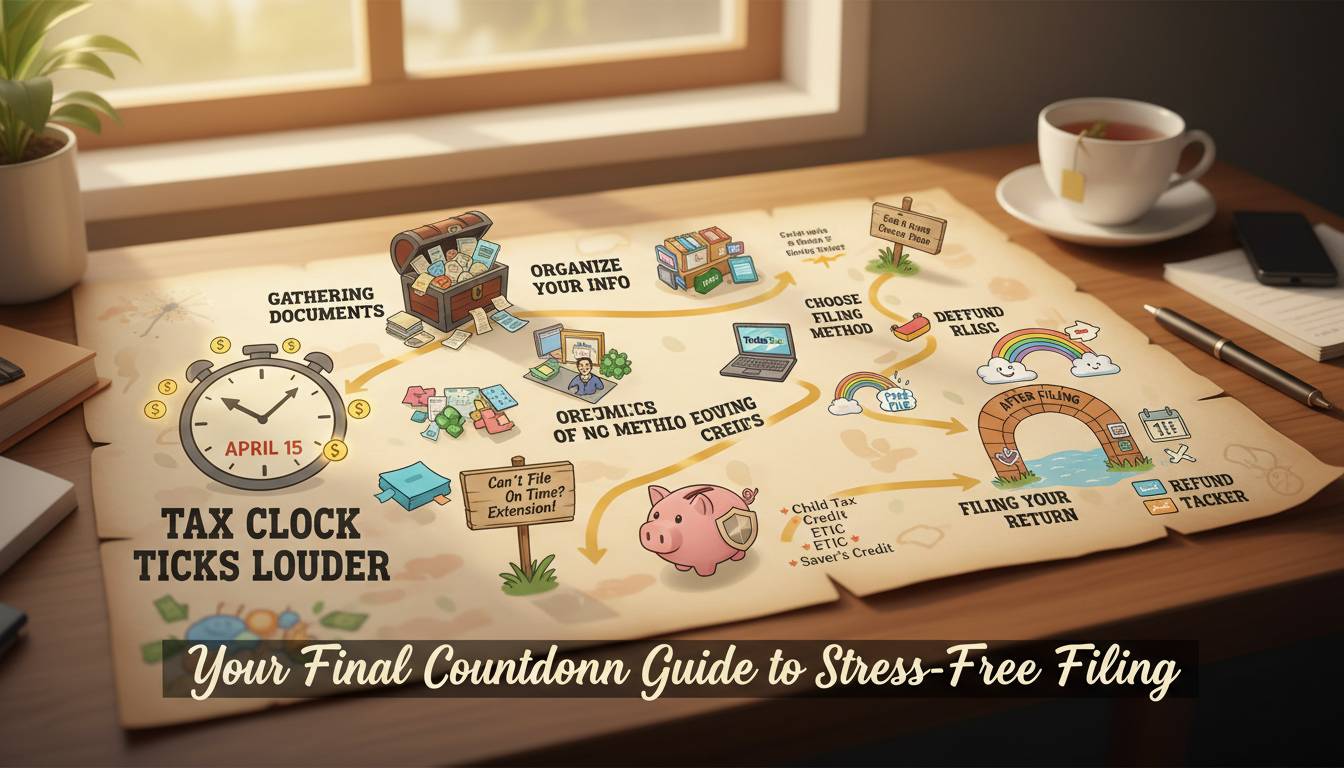

—on “Tax Clock Ticks Louder: Your Final Countdown Guide to Stress‑Free Filing.” It follows the guidelines with a clear intro, skimmable structure, at least one quote, and an FAQ.

Final Countdown: File Your Taxes Without Regret

You’ve reached the tax deadline, and ticking clock’s louder than ever—just breathe. File now, save stress, avoid late‑filing fees and missed deductions. This guide walks you through last‑minute filing, what you can still claim, how extensions work, and what to avoid—so you can get it done with confidence.

Why Acting Fast Matters (And What You Still Can Do)

Time’s short but not gone. The IRS deadline (typically mid‑April, around April 15) is firm—missing it can mean penalties, interest, audits, even identity theft risks. But even in the eleventh hour, you can file, seek an extension, or e‑file and pay later.

- Filing late without an extension triggers a failure‑to‑file penalty (often 5% per month), and interest begins accruing on what you owe.

- Importantly, if you’re owed a refund, there’s no penalty for filing late—but you lose your refund if you wait more than three years.

Beyond general rules, some deductions and credits are still claimable—like retirement contributions if done by the deadline, or education credits if tuition qualified. On the flip side, waiting means less chance to fix mistakes before audit‑season picks up.

Quick Steps to Calm the Storm

- Gather everything you’ve got: W‑2s, 1099s, receipts.

- Choose fastest route: e‑file, even if paying later.

- Max your deductions: review home‑office, retirement, charitable.

- Consider an extension if you truly need it—but pay an estimate now.

- Double‑check identity protections (EIN, proper SSN, PIN).

- File, hit submit, and breathe easier.

Smart Actions in the Final Hours

E‑Filing Is Your Best Shot

E‑filing speeds things. It’s faster, confirms receipt, and reduces input errors than paper. Many filers use software that flags missing numbers or mismatches. Makes life easier when you’re rushed.

Estimate and Pay What You Can

If you’re short on time, e‑file with an estimate. Overpaying a bit is okay; you’ll get a small refund or credit. The key is beating the deadline—the IRS judges penalties on payment date, not tax form date.

Claim All Available Deductions

Even late in the process, you can still take advantage of:

- Traditional IRA contributions done by the deadline

- Student loan interest paid early in the year

- Last‑minute chaotic cleanup of charitable gifts (but docs must arrive by deadline)

Learn About Extensions

Filing Form 4868 grants you six more months (usually until October). But the extension only covers filing—not paying. You’ll still owe, and interest accrues. Still, it buys peace of mind for accuracy.

Real‑World Quick Case

Sarah, a small‑biz owner, realized April 15 was yesterday after chasing numbers. She e‑filed an estimate, paid most of what she guessed, then sent in receipts for her business supplies. It wasn’t perfect—but she avoided failure‑to‑file fees and still captured deductions she almost missed.

She said later:

“It felt chaotic, but doing something—anything—made all the stress melt away. And later, I fixed two small mistakes via amended return.”

Sometimes, imperfect action beats perfect inaction.

How to Avoid Panic Next Year

- Set February alerts in your calendar.

- Collect W‑2s, 1099s by February 1.

- Use simple tax tools all year (e.g., Mint, TurboTax) to prep gradually.

- Consider quarterly estimates if you’re freelancing or run a side hustle.

These small changes keep you ahead, not scrambling.

Common Last‑Minute Mistakes (And How to Dodge Them)

| Mistake | Risk/Penalty | Quick Fix |

|————————|—————————————-|——————————————-|

| Missing SSN or wrong EIN | Rejection, audit red flag | Double-check, especially last 4 of SSN |

| Overlooking simple claims | Lost refund opportunities | Review common credits (education, kids) |

| Forgetting extension payment | Penalty & interest even if extended | Submit an estimated payment by deadline |

| Not securing e‑file PIN | Filing delay or rejection | Set up or recover PIN ahead of time |

A few minutes reviewing these can make a big difference.

Final Words (Don’t Wait, Be Smart)

Time’s pressing, but last-minute doesn’t have to mean frantic. A calm, planned scramble with smart steps beats ignoring the deadline. E‑file, estimate payments, grab deductions, or extend—and still own a smooth filing process. Getting something done now gives space later to amend or optimize.

FAQs

How late can I file without penalty?

You can file anytime, but late filing triggers penalties. The IRS charges a failure‑to‑file penalty (typically 5% per month on the unpaid tax), so the sooner you file—even with an estimate—the better.

Can I get an extension if I miss the April deadline?

Extensions must be requested before the deadline, using Form 4868. It gives you six more months to file, but not to pay. You still owe any tax due by the original date, plus interest.

Will I lose my refund if I file late?

If you’re due a refund, there’s no penalty for filing late. But you must file within three years to claim it. Undelivered refunds past that time usually expire.

What deductions can still apply at the last minute?

You can still claim deductions if they’re applicable and documented by the deadline. That includes IRA contributions, student loan interest, and charitable gifts—just ensure payment or documentation arrives on time.

What if I notice mistakes after filing?

You can file an amended return (Form 1040-X). It’s common, especially after rushed e‑filing. Use it to correct missed deductions, income misstatements, or other errors.

Will filing an estimate affect audit risk?

Making a good‑faith estimate doesn’t raise audit risk. Errors or omissions detected later can be fixed with an amended return. The IRS expects estimates if you genuinely didn’t know the exact number by filing time.

Here’s to getting taxes done—not perfect, but done, smart, and stress‑managed.