Texit Coin is currently trading around $0.89 to $0.90, driven by a blend of speculative enthusiasm, limited availability, and marketing tactics—which together create rapid swings in perceived value. While supporters point to features like fair launch, mining mechanics, and community momentum, a large volume of skepticism from analysts and users alike raises questions about sustainability and legitimacy.

Price Journey and Volatility Dynamics

Texit Coin (TXC) has seen drastic price fluctuations since launching in 2024. For instance, CoinMarketCap reports a current price near $0.8945 USD, down slightly over 2.5% in the past day, with a 24-hour trading volume around $300K . Conversely, the project’s own mining platform claims the coin surged from approximately $0.03 at launch to $1.40 recently—a staggering 4,566% increase . Yet, other sources cite mid-2025 trading near $1.02 with projections toward $1.17 by 2028 . This disparity illustrates how much of the value shift results from narrative and promotional push rather than stable fundamentals.

Core Features and Value Claims

Several factors are being promoted as value drivers:

- Fair launch and no pre-mining create a sense of equity among participants .

- Mining is permissioned exclusively in Texas, with fast block times (around 3 minutes) and a capped supply near 353 million TXC .

- The project positions itself as a grassroots, community-led digital currency that leverages local identity and trust .

These attributes are designed to suggest a tangible value base: fairness, locality, and technological rigor.

Contrasting Narratives: Promotion vs. Criticism

Despite these selling points, the online crypto community has raised repeated red flags:

- A persistent thread in r/CryptoScams cites features common in classic pump-and-dumps and warns investors to “run” if suspicion arises .

- Discussions across Reddit often describe centralized control, insider marketing, and questionable withdrawal mechanics—typical warning signs .

- One user decried the project as reminiscent of Bitconnect 2.0, focusing more on promotional hype than substance .

- Media analysis underscores the red flag nature of a coin doubling quickly without technical validation—from “scam for sure” sentiments to forums questioning withdrawal reliability .

Such concerns elevate the perceived risk in TXC’s meteoric rise.

Community Stories: Believers vs. Doubters

Narratives vary widely, and here’s a glimpse:

- Positive anecdote: Art Bermudez shares a personal experience of buying a mining seat in February 2025, earning TXC daily. According to him, the price climbed from $0.27 to $2.81 in six months—almost a tenfold rise .

- Skeptical view: Many commenters warn of referral traps, centralized control, and the founder’s possibly shady history .

- Supportive-but-wary voices remark how some earned payouts have recouped investment, yet they caution about long-term sustainability .

These diverging stories illustrate that while some see tangible gains, others view the structure as inherently precarious.

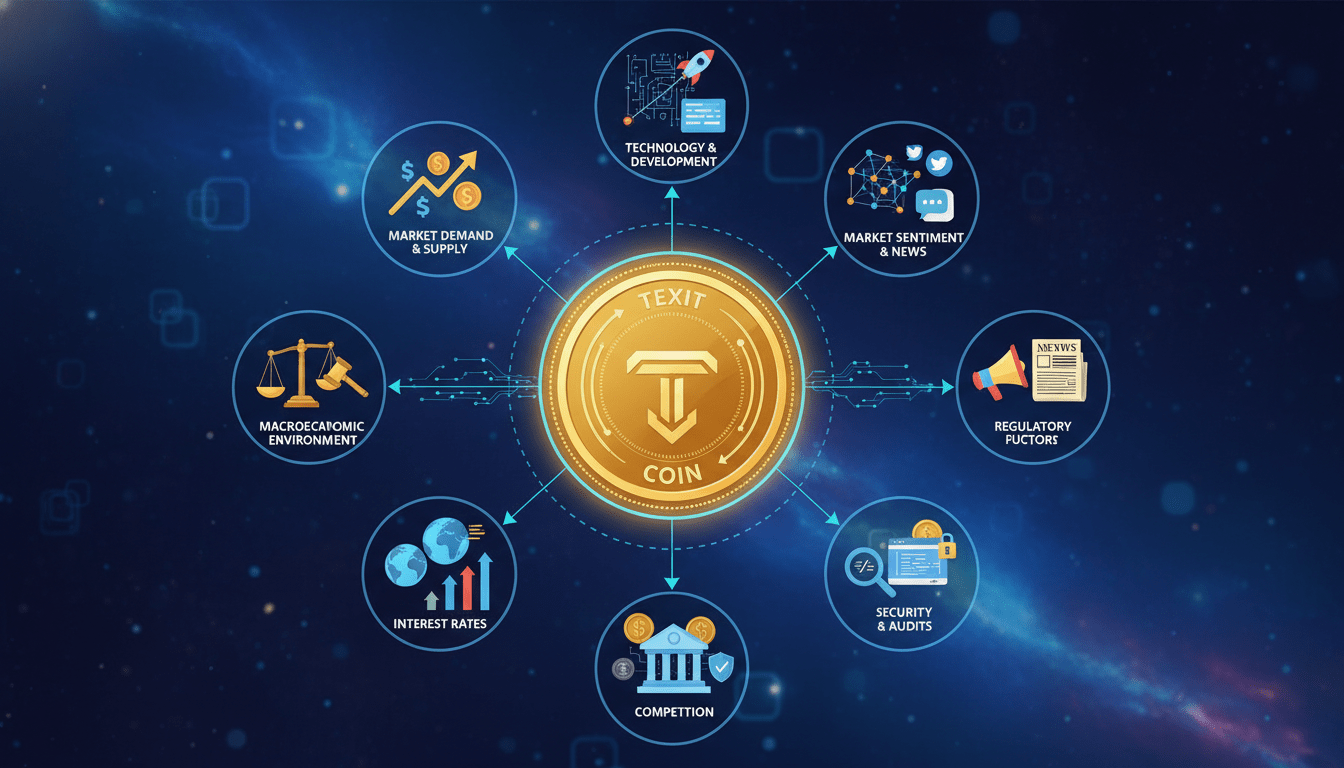

What’s Actually Driving the Price?

This complex mix underpins TXC’s value today:

- Speculative Demand & Visibility: Bold marketing efforts—billboards, local ads—make Texit visible, drawing in curious investors despite volatility .

- Psychological Momentum: Many new entrants feel FOMO—“what if this is the next big thing?”, especially when they hear stories of early winners .

- Perceived Utility & Community Ethos: The narrative of a fair, Texas-centered coin taps into local pride and a desire for financial independence—making the project emotionally resonant .

- Supply Constraints: With limited token supply and restricted mining, scarcity theory can artificially boost value—provided demand sustains .

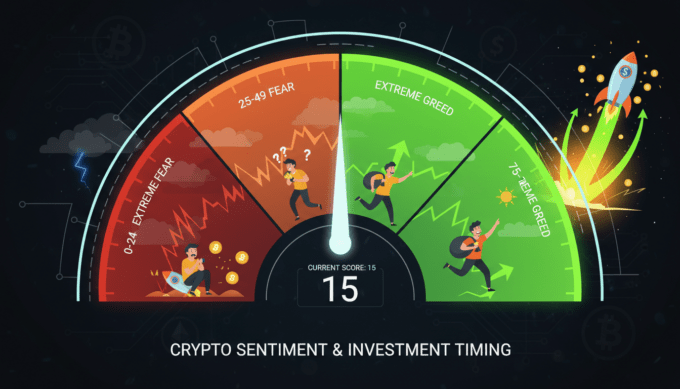

- Skepticism and Risk Awareness: Countervailing voices in forums temper irrational exuberance, reminding prospective buyers of the risks .

Expert Insight

“If it looks too good to be true… it probably is.”

This mantra echoes in investor communities around TXC, where rapid price gains and persistent red flags make many question whether any ‘value’ is genuine or just manufactured momentum.

Conclusion

Texit Coin’s value is propelled less by established fundamentals and more by a potent blend of storytelling, visibility, and speculative psychology. While some early adopters report gains, the overwhelmingly skeptical chatter underscores the coin’s high-risk nature. Anyone considering TXC should approach with extreme caution, prioritizing due diligence over hype, and recognizing the potential for dramatic losses alongside any gains.

FAQs

What is Texit Coin’s current price and recent trend?

Recent readings place Texit Coin between $0.89 and $0.90 USD, showing slight daily declines amid ongoing volatility.

What features are promoted as supporting TXC’s value?

The project emphasizes fair launch with no pre-mining, Texas-specific permissioned mining, capped supply, and fast block times to present fairness and technical credibility.

Why are there so many warnings calling it a scam?

Concerns stem from signs of centralization, referral-driven marketing, opaque withdrawal mechanics, and parallels to past crypto scams like Bitconnect.

Have investors actually made money?

Some users report solid short-term gains, especially those who entered early or mined diligently. But such anecdotes are anecdotal, and long-term stability remains uncertain.

Should I invest in Texit Coin?

Given the widespread skepticism, unclear fundamentals, and token’s speculative nature, investing should be approached with great caution—only using funds you can afford to lose.

What’s a more prudent way to evaluate such crypto projects?

Research the team’s background, seek on-chain transparency, demand verifiable exchange listings, and avoid projects relying heavily on referral or MLM-like structures.

(Word count: approx. 1,050)

Leave a comment